Overview and Solution Architecture

We facilitate the building of trust among financial institutions and SMEs by optimizing access to financial services, helping SMEs to manage their communications and business processes with stakeholders in the ecosystem more cost-effectively and efficiently.

Solution Highlights

-

Digital hub to connect with financial institutions

Create and update your company profile, and share it with multiple financial institutions at your control for the enrolment and maintenance of financial services, all on the same platform.

-

Fuel business growth without the hassles

We are streamlining financial service access from enrolment to maintenance, so you can get what you need to grow your business anytime and anywhere in one go without the back-and-forth paperwork.

-

Manage business needs in safe hands

Great convenience doesn’t mean great risks. At RD, your data is always processed and protected in accordance with the banking industry’s latest cybersecurity standards.

-

Build trust with data analytics and accreditation

Foster confidence with business partners with our 5-star accreditation system, which is enriched by data analytics based on wallet activities and alternative data sources.

Your Challenges and Our Solution

-

-

Your Challenges

-

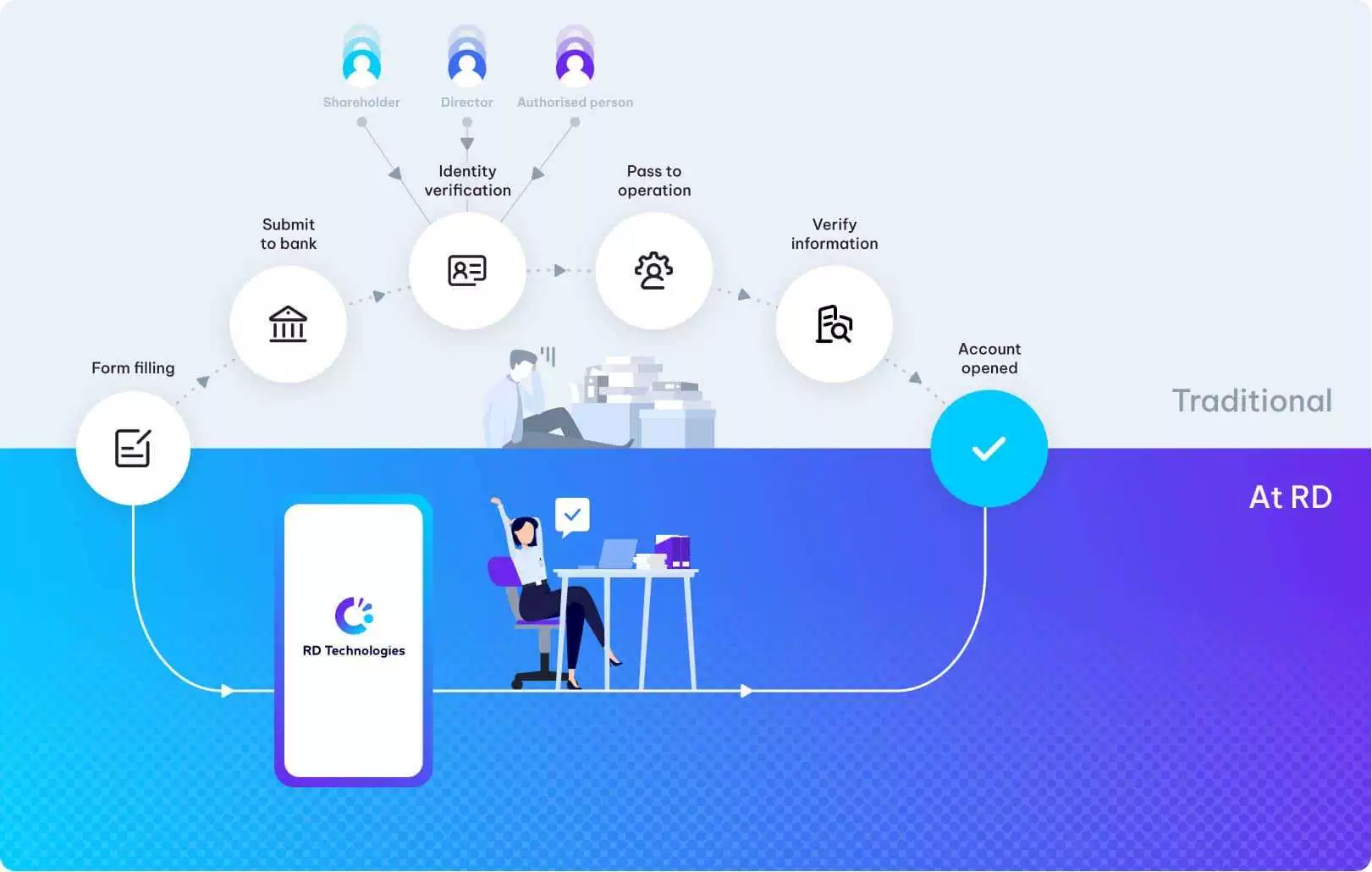

1) Even if the key people are not in Hong Kong, they must visit Hong Kong in person to provide relevant information to authenticate their company and personal identity to meet the requirements of bank account opening and customer due diligence (CDD).

2) SMEs generally use services provided by more than one bank to address different business and operational needs. Due to CDD and enhanced due diligence (EDD), SMEs often face tedious and time-consuming processes in providing the same set of company documents and other relevant information to multiple banks for account opening. The whole process is both time consuming and costly.

3) For account maintenance, SMEs spend lots of time to cater requirements from banks once they have information updated, or regular review.

-

-

Our Solution

-

A corporate customer, through its participation in RD ezLink, can create a verified company profile in digital format, and if it so wishes, the profile can be shared with banks or other financial institutions for account opening and ongoing CDD purposes, thereby avoiding the need for repeated manual efforts in form-filling by the customer and processing by banks.

RD ezLink would greatly improve customer experience and help reduce operational costs in acquiring and maintaining corporate customers, especially SMEs. Moreover, RD ezLink aims to make use of payments made by the customer and other data originated from e-wallets or other relevant sources to provide data analytics that would facilitate the access to credit facilities of banks or other financial institutions.