Overview

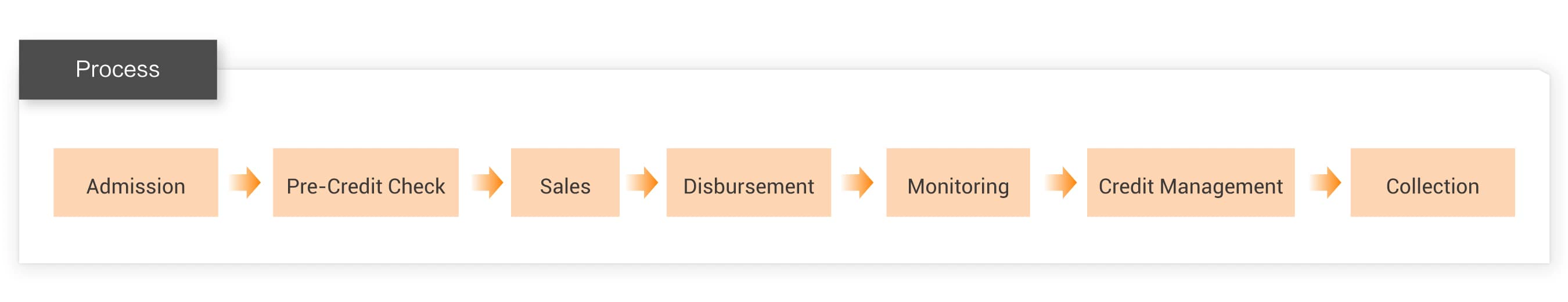

The digitization of the lending process brings many powerful benefits for Financial Institutions (FIs), including data-driven marketing, improved customer experience, smarter and quicker decision making, higher consistency in the lending process and portfolio performance, and significant cost savings.

The Alibaba Cloud Digital Credit Lending Solution leverages most of the advanced cloud infrastructure, AI technologies, and in-depth algorithms practiced by Ant Group to digitalize your entire lending process and control risks. It amasses information collection, decision making, risk management, and on-going monitoring, taking your digital business to a new level and helping you stay competitive in the industry.

Solution Highlights

AI-Driven Dynamic Risk Modeling

AI technology offers you dynamic risk modeling capabilities for speedy data-driven decision making. You can auto-train and deploy active anti-fraud models and rules in less than an hour and deploy complex rules and models in days.

Out-of-the-Box Fraud Detection

The Device Security offers an SDK that can be easily integrated into your digital lending mobile apps. With minimum customization, you can start a digital lending business with real-time fraud detection capabilities.

High Digital Lending Efficiency

Empowered by robust cloud and AI technology, this solution optimizes the human elements on risk management and governance and drives efficiency and productivity gains in your digital lending processes.

In-Depth Industry Insights

This solution comes with various scorecard templates and algorithms that are backed by Alibaba and Ant Group’s years of experience. These algorithms have helped many FIs worldwide develop local credit scoring models to accelerate business success.

Zero Coding Modeling

The PAI Studio machine learning platform helps you develop risk models and fraud models with 0 coding, allowing you to turn your domain experts into data scientists with a flat learning curve and little effort.

Southeast Asia Optimization

This solution is optimized for FIs in Southeast Asia. Both Optical Character Recognition (OCR) and Natural Language Processing (NLP) are trained with additional data from Southeast Asian languages and can better digitalize customer data in this region.

Learn more about Alibaba Cloud Digital Credit Lending

Get Professional SupportHow It Works

Your Challenge

Credit and lending are getting more digital, complex, and dynamic. Many Financial Institutions (FIs) want to speed up the process to increase operational efficiency. This requires FIs to automate the credit lending process, manage data cross different data silos, develop credit risk models based on unified data assets, and enable data driven real-time decision making.

Our Solution

-

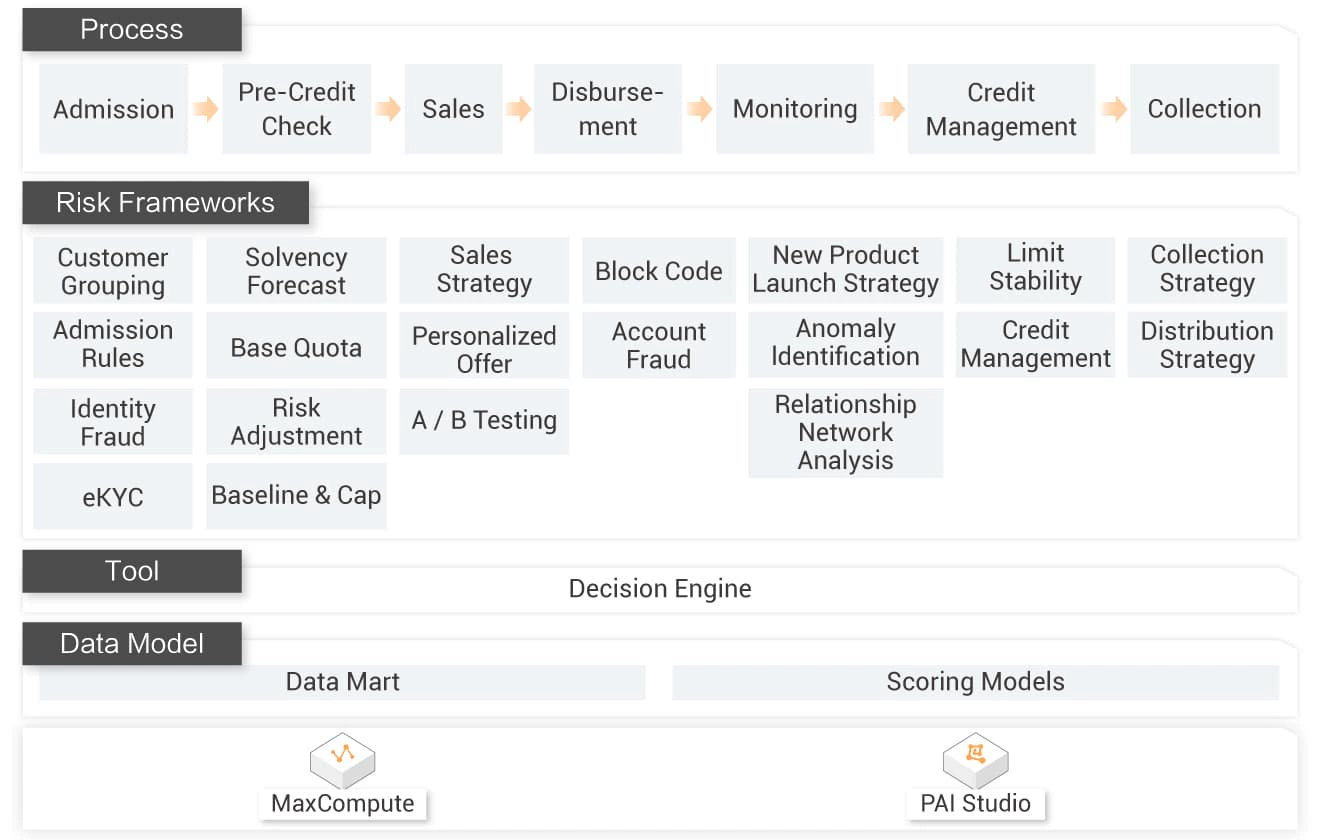

Alibaba Cloud's credit risk management solution with AI allows you to automate and simplify the credit lending process. Optical Character Recognition (OCR) and Natural Language Processing (NLP) technologies can help digitalize customer documents to save both you and your customers from cumbersome paperwork and improve efficiency. MaxCompute and DataWorks can break down and transform traditional data pipelines into agile and transparent data and help you build holistic and consistent data assets across the organization. The Alibaba Cloud PAI studio helps you quickly develop credit risk models and fraud models with united data assets for speedy decision-making. Alibaba Cloud’s powerful Decision Engine can help you deploy complex rules with up to 2000 decision trees and return results in less than 200 ms. Its built-in AI function automatically recommends new variables and policies based on your business.

Decision Engine

Real-time calculation engine developed by Alibaba Cloud for credit risk management

Contact Sales

Your Challenge

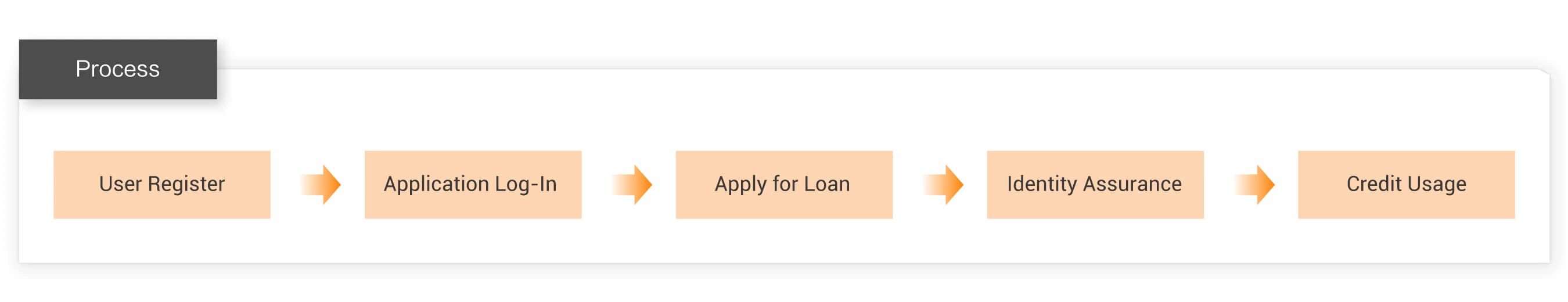

The digitization of the lending process can be very challenging in entity resolution, loan fraud, and promotion abuse. It requires process speed and simplicity.

Our Solution

-

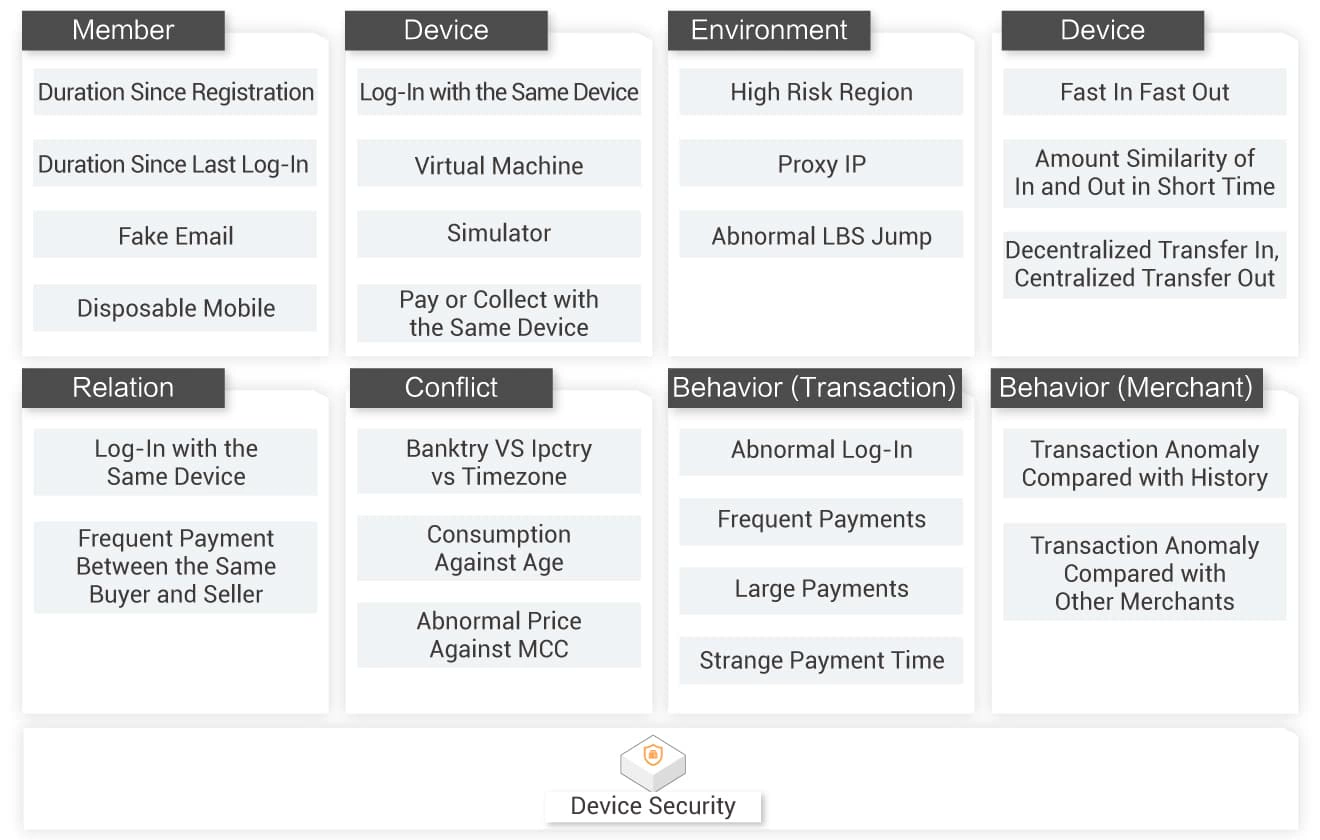

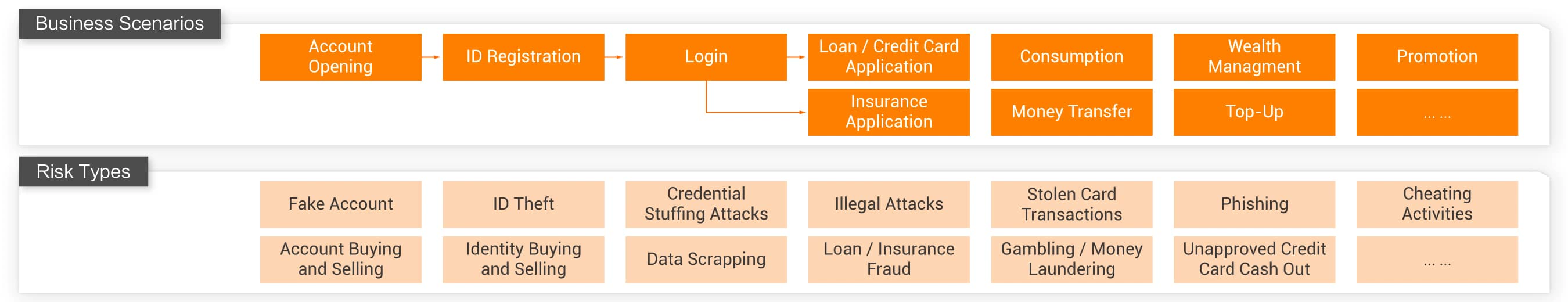

Over 700 security data scientists from Alibaba Cloud developed a device security SDK based on more than ten years of experience with fraud detection and prevention. The device security SDK helps you analyze rich data from users, merchants, transactions, and smart devices and make accurate fraud detection in seconds. This solution protects you throughout the lifecycle of the digital loan process from protocol attacks, Anti-Money Laundering (AML), bot and emulator operations, and other risky activities.

Your Challenge

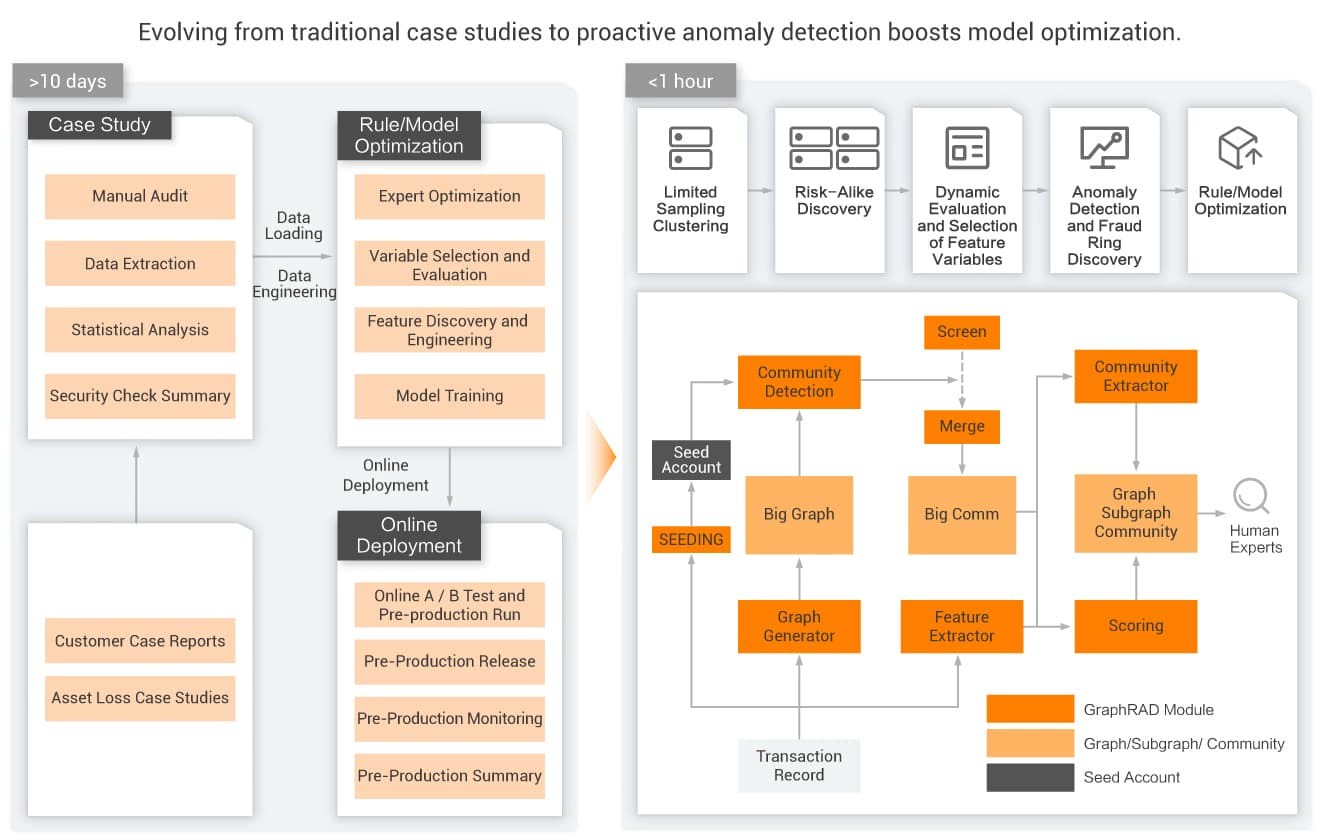

Traditional fraud prevention based on historical data and human supervision usually takes at least ten days to develop a new solution against new frauds, leaving your assets exposed and vulnerable online during the intervals. Limited and imbalanced fraud samples with insufficient data can also make fraud modeling difficult.

Our Solution

-

Alibaba Cloud’s active fraud prevention solution uses self-learning and unsupervised learning algorithms to target new fraud cases and detect potential fraud networks. It dynamically evaluates and selects feature variables, detects anomalies, discovers fraud rings, and develops new fraud models within an hour. As a result, your turnaround time before the protection of new models and your potential losses will be significantly reduced. This solution also helps you deal with the lack of data. It uses label propagation to tag other similar undiscovered cases and expand your data, allowing you to build robust and reliable fraud models.

Learn more about Alibaba Cloud Digital Credit Lending

Get Professional SupportRegulatory Compliance for Financial Industry

Alibaba Cloud is committed to facilitating Financial Institutions (FIs) in compliance with the financial industry-specific regulatory requirements.

Industry Specific

Compliance for Different Regions

Learn more about Alibaba Cloud Digital Credit Lending

Get Professional SupportRelated Resources

Partner

LGMS PCI DSS Professional Services on Alibaba Cloud

PCI DSS professional services provider currently offers an assisted, user friendly and easy to use SAQ system on Alibaba Cloud.

Learn more >Whitepaper

How Can Your Bank Use AI and Machine Learning to Avoid Disaster?

How your bank can use data, machine learning and AI to improve risk management and avoid serious incidents.

Learn more >Trust Center

Security & Compliance Center

We are committed to providing stable, reliable, secure, and compliant cloud computing products and services.

Learn more >