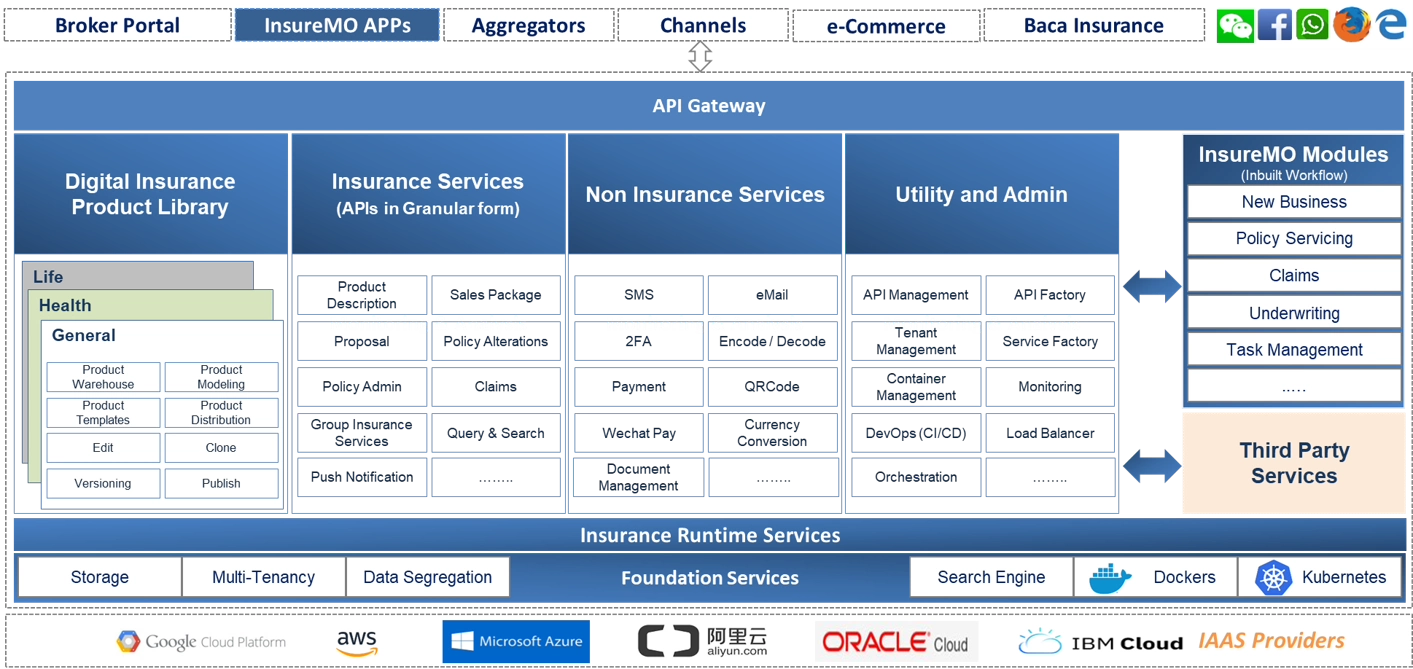

Overview and Solution Architecture

Overview

InsureMO® (for “Insurance Middle Office”) is designed to accelerate insurance innovation, improve connectivity among stakeholders, and handle the massive volume, variation, and velocity of the insurance business in the “Digital Age.”

As a platform-as-a-service (PaaS) used by hundreds of insurers in nearly 40 countries and powers $billions GWP per year, InsureMO acts as middleware for the insurance industry, freeing insurers from legacy constraints, and unlocking their ability to innovate and connect to stakeholders.

InsureMO has a full set of insurance APIs and microservices for general (P&C), life, and health insurance businesses covering the entire policy lifecycle. InsureMO supports Open API collaboration, is based on containerization technologies, and enables third parties to develop applications. Explore the PaaS platform at InsureMO.com.

Solution Highlights

InsureMO is rapidly becoming the operating system enabling easy and fast digitization of insurance applications, APIs and ecosystems allowing insurers and channels to connect products. Solution providers, InsureTechs, and tech companies can now integrate digital insurance software, while distributors connect insurance apps – all at lightning speed.

-

For Executive Decision-Makers

InsureMO is the proven middle office platform enabling the rapid launch of insurance products across digital distribution points.

-

For Insurance Product Managers

Choose from hundreds of pre-defined products, created from tens of thousands of product components – product memos can now be aligned with software design principles!

-

For Insurance Software Developers

Software Engineers can rapidly increase productivity through the use of insurance-specific API’s, Microservices, dev ops level app development, hosting, and monitoring.

Your Challenges and Our Solution

Your Challenges

Insurers’ outdated and inflexible legacy systems are not able to meet 3V (Massive volume, Massive variation and Massive velocity) challenges of digital insurance. However, building a new system is time consuming and costly.

Our Solution

-

This solution utilizes HBS Channel Integrator to standardize APIs for service channels, such as online account opening and mobile banking, and support files of different formats, including common text, XML, JSON, etc. The data migration process can be automated based on Alibaba Data Integration Service to transmit, convert, and synchronize data in an advanced distribution architecture with modules, such as dirty data processing and flow control. The knowledge base with operational reports is updated regularly, so you can conduct knowledge transfer with up-to-date information and provide remote support for customers in time.

Your Challenges

Insurance companies want to adopt an IT strategy of building an agile and scalable architecture to meet the product time-to-market and channel integration requirements in the digital age. Insurers want to achieve connectivity in a cost-effective and short-time manner.

Our Solution

-

Use out-of-the-box headless APIs to accelerate your time to market and connectivity to any digital distribution channel.

•Two-Speed-Architecture: Connect to your existing legacy system without going through a demanding monolithic core replacement.

•Higher efficiency through In-Built Workflows: Power your products with the latest plug-and-play apps with dynamic case management and built-in formulas, rules, and configurable workflows!

•Enhance your customer experience: Easy interface to enable users to manage and complete tasks effectively.

Your Challenges

Ecosystems/verticals aim at launching insurance related business to monetize existing customer base and increase customer adhesive. However, they do not want to start from scratch, they would like to flatten the learning curve across general, life and health insurance products and access to ready-to-run reference insurance products and reference insurance apps.

Our Solution

-

Adopt InsureMO to launch and scale insurance products across markets and regions with reusable integration assets.

•Launch and scale your insurance product portfolio swiftly on your channels: Ready digital connectivity with existing and new carriers via API.

•Work with existing or new underwriters across products and markets: One-stop solution for launching insurance products on your platforms - be it multiple products, multiple carriers or multiple regions.

•Massive Volume, Velocity and Variation: Adopt easy-to-use interface to enable users to manage and complete tasks effectively.