The advent of artificial intelligence (AI) triggered a research and development (R&D) boom in various industries around the world. Due to powerful computing capability and excellent smart system functionality, AI has become more critical to people's everyday lives. In turn, this has led tech giants and venture capitalists to increase investment in artificial intelligence companies.

As AI becomes more popular around the world, CCID expects that the global AI industry market is likely to approach USD $39 billion in 2018 and USD $58 billion by 2020. In the eyes of many investors, artificial intelligence technology can make more informed decisions, allowing entrepreneurs and innovators to create products of even higher value for their customers.

However, judging by the history of the two waves of the artificial intelligence technology, as well as the decisions of global tech companies such as Alibaba and Apple, focusing on AI technology investment alone is not a wise decision. But why? Because the deeper value behind the technology is even more critical.

Data from CB Insights shows that the total amount of financing for artificial intelligence startups worldwide reached a record 15.2 billion USD in 2017. Internet companies have become more prominent in artificial intelligence investment. According to PitchBook data, the artificial intelligence and machine learning field received a total of more than 10.8 billion USD in venture capital in 2017. These figures indicate that the market is optimistic about the future of artificial intelligence. AI enterprises hope to empower AI technology, inevitably transforming artificial intelligence into a representative trend of our generation.

However, as far as the currently popular AI goes, we are already in its third wave of popularity. In March 2016, AlphaGo's game of Go against Lee Sedol brought this technology to the forefront of the public consciousness, putting the words "artificial intelligence" on everybody's lips.

As for the first two waves of popularity, the first happened in the 1950s, when Alan Turing proposed the symbolic Turing test. Milestone technologies and applications such as mathematical proof systems, knowledge reasoning systems, and expert systems had suddenly set off the first artificial intelligence craze among researchers.

The second wave came about in the 1980s, when technology based on statistical models quietly emerged. Not only did it see the progression of speech recognition and machine translation technologies, but artificial neural networks also found application in areas such as pattern recognition. More importantly, in 1997, the Deep Blue computer system defeated the human chess master Gary Kasparov, which brought public enthusiasm to a peak.

It was during this period that AI first received significant hype and rapid increases in investment. Due to the situation at that time, investors did not adequately consider the value behind these entrepreneurial ideas but merely raised funds for what they believed to be an exciting technology. This led to the failure of most of the first generation AI startups, and they eventually faded away. For example, artificial intelligence companies founded in the 1980s such as Symbolics, IntelliCorp, and Gensym have either wholly transformed or no longer exist.

Now, 40 years later, we are facing a very similar problem. Even though the technology today has become more complicated, there is still the undeniable fact that AI has yet not created sufficient value for consumers. This is why Xiao Zhijun believes that investing in AI or "deep technology" is not a wise decision. To the contrary, it is the outlook of Xiao Zhijun that the deeper value behind AI, rather than the technology itself, should be the target of investment.

Since 2000, venture capital investment in AI has grown six fold, and the number of AI startups by fourteen times in the same period. The numbers are incredible, but the capability of AI has often been exaggerated and over-hyped in the process. The areas where AI startups have focused on have an even more significant impact on social and capital movements.

However, in the course of these developments, we don't seem to have taken into consideration whether or not we need WordPress pages developed by AI. By focusing on the technology, or the vertical fields of deep technology - like some AI or blockchain startups tend to do - it's easy to overlook the company's most commercially valuable aspect, i.e., what problem do they solve? Therefore, what is the deeper value?

Unfortunately, under the current circumstances of AI, more startups have failed to resist the temptation to feed the hype and join the craze.

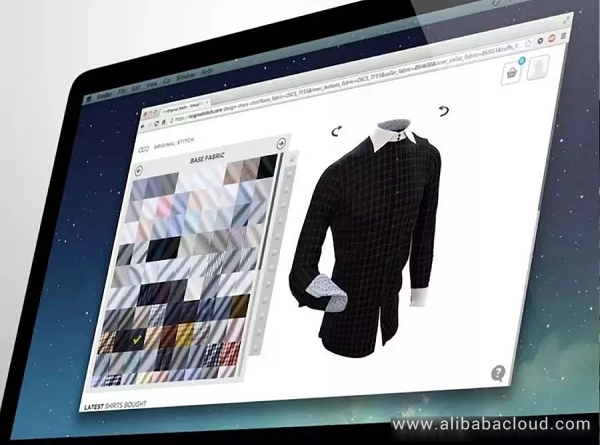

Take the San Francisco startup Original Stitch for example. It has positioned itself as an "AI tailor", capable of providing users with tailored shirts using computer vision software that analyzes photos the user uploads to the company website. The bold idea has won Original Stitch a massive investment of 5 million USD.

Unfortunately, users tend to find shirts made using Original Stitch's AI very uncomfortable, either too tight or too long. Hence, the company has asked customers to provide their shirt size, essentially defeating the purpose of the technology. We believe that machines will eventually be better able to make custom shirts, whether or not they use AI technology. However, for the moment we are only concerned with right fitted shirts.

Even though the technology is still evolving, still making breakthroughs, the current technology is still quite far from perfect. If the technology is unable to create proper value, then we have to consider the question of whether or not the technology is necessary. Therefore, if you want to invest in AI, Xiao Zhijun suggests investing in companies that use the technology to provide actual, deep value to customers.

Right now, all a start-up has to do is advertise itself as an AI company and people generally perceive it as a forward-looking, sustainable company. However, it's important to remember that looking to the future doesn't always mean developing futuristic technology. Besides, in the long run, business models with sound technology that's useful in the everyday lives of users tend to be much more sustainable.

Here we take into consideration seven of the most valuable tech giants in the world: Apple, Amazon, Alphabet (Google's parent company), Microsoft, Facebook, Alibaba, and Tencent. They are all currently developing AI and other deep technologies. However, the majority of them did not start out as high-end tech companies. Most came from humble beginnings, solving problems through "shallow" techniques.

For example, Alibaba and Amazon both began as e-commerce platforms, and Tencent started with an internet chat platform. Now, all three companies have invested vast amounts of money in innovative technology that helps them continue to expand and grow their brands. Therefore, it means that while investing, it is important to not invest solely on deep technology, but to invest on a technology that creates deep value. In other words, it is the necessity of deep technology that gives it value.

15 years ago, an investor that wanted to invest in deep technology would not be likely to look at Facebook, as it is a company built on a PHP social networking platform (PHP is a simple scripting language built on a web framework). However, in the years following the launch of Facebook, the company has embedded deep technology in its products and used innovations to improve them, all with the intention of creating deeper value for the user.

There are other examples all over the world including Southeast Asia. Taking local tech giants like Grab and GO-JEK as examples, they were inspired by Uber and Lyft respectively, and have since grown into two of the most valuable companies in the region.

If you must invest in deep technology, then consider another problem: today's cutting-edge technology will all likely become standard tech over time. It was not long ago that today's high-res displays were both a novelty and technologically fascinating. Today, these displays are everywhere and generally available to anyone and everyone.

Deep technology is currently in a similar situation. Whether it's Bitcoin, cryptocurrencies, next-gen solar cells, or even the reusable rockets built by SpaceX, these are all functional technologies that will inevitably become standard over time.

In short, it would be wise of investors to carefully consider the future and think about what they want to achieve through this technology, or in other words, what kind of value the technology can create. Subsequently, further consider whether AI and deep technology are necessary to establish that value. Finally, the question is not how you feel about AI in general, but whether or not it is capable of generating lasting value.

Read similar blogs and learn more about Alibaba Cloud's products and solutions at www.alibabacloud.com/blog.

How Alibaba Cloud Evaluates Customer Product Reviews on Alibaba E-Commerce Platform

How to Create and Deploy a Pre-Trained Word2Vec Deep Learning REST API

2,605 posts | 747 followers

FollowAlibaba Clouder - June 29, 2020

Alibaba Clouder - November 14, 2018

Alibaba Clouder - December 23, 2016

Alibaba Cloud Community - July 12, 2022

Alibaba Clouder - March 8, 2019

Alibaba Clouder - February 4, 2019

2,605 posts | 747 followers

Follow E-MapReduce Service

E-MapReduce Service

A Big Data service that uses Apache Hadoop and Spark to process and analyze data

Learn More MaxCompute

MaxCompute

Conduct large-scale data warehousing with MaxCompute

Learn MoreMore Posts by Alibaba Clouder