This project is from Xu Yuanjun and Wang Yangguang, which was awarded the Most Voted Award in the 2025 Quick BI Global Data Visualization Hackathon.

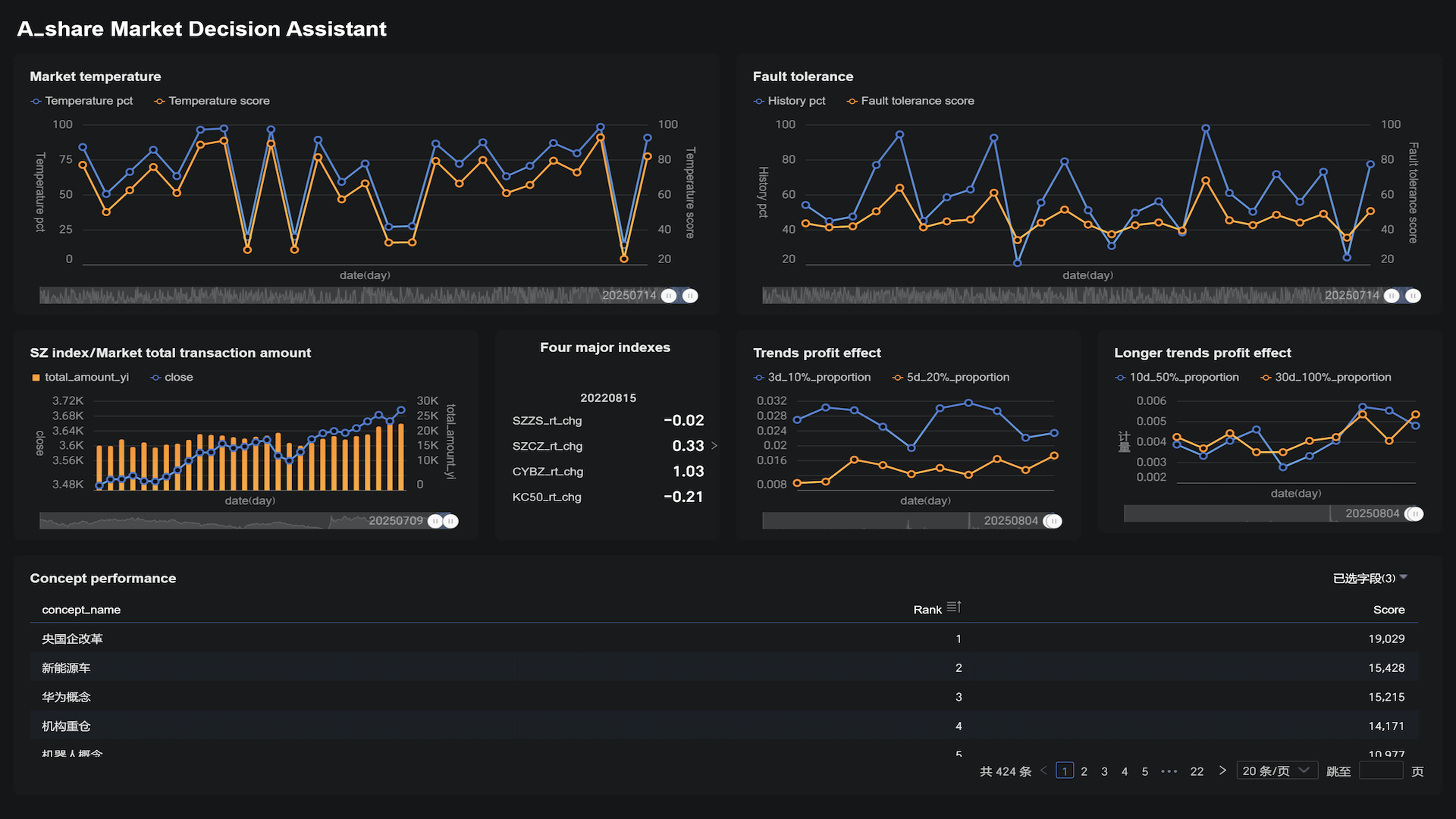

This project is a trading decision assistance dashboard for the A-share market, providing daily-frequency, human-generated market-wide indexes alongside foundational data. It helps traders gauge whether the market temperature is overheated or excessively cold, assess opening fault tolerance, and refine their trading pace while evaluating trading risk—delivering practical trading value.

🔗 Explore the project here

Many people enjoy stock trading, but irrational opening has long been a problem to people—even seasoned traders can make mistakes because of it.

Based on the unique trading and speculative mechanisms of China’s stock market, our team has developed a dashboard with five key indexes, including Market Temperature and Fault Tolerance, etc., combined with other foundational data to provide trading data at a daily frequency for investors to analyze after each market close.

We collect the data ourselves and analyze it independently. The dataset offers three years of daily data across various market conditions and market ecologies, and supports one-click generation to streamline daily data analysis and market assessment.

Our data dashboard is highly interactive, clean and intuitive, and delivers high data usability—making it exceptionally user-friendly for everyday business scenarios.

For example, the Fault Tolerance index includes: Today’s performance of stocks that experienced large intraday drawdowns yesterday; Today’s performance of stocks that were limit-down yesterday; Today’s performance of stocks that touched limit-up but failed to close at limit-up yesterday.

Due to the A-share market’s unique limit-up/limit-down mechanism and its far-reaching effects, we place strong emphasis on the processing and use of limit-up/down data, and some other similar data. For limit prices, since the market does not strictly use a flat 10.00% threshold to determine a limit-up (it may be 9.96%, 10.03%, etc.), we pre-compute the next day’s limit-up and limit-down prices using the prior day’s closing price to ensure accurate classification.

We do not use any rolling windows at any stage when constructing factors and indexes. This makes it easier to situate current readings within their historical percentiles, and provides especially strong signaling in extreme regimes—well aligned with traders who seek timing inflection points and care deeply about trading rhythm.

Stock analysis is highly complex and uncertain, and the A-share market has its own unique trading logic on top of that. The author’s years of trading experience add practical business value across the project design, factor selection, and data presentation.

The team is composed of two NUS students, from CDE, major in Industrial System Management and Engineering, Data Analytic. The captain, Xu Yuanjun, has once achieved several doubles in stock trading.

134 posts | 26 followers

FollowAlibaba Cloud Community - June 4, 2025

Alibaba Clouder - November 10, 2020

Alibaba Cloud Community - June 24, 2025

Alibaba Cloud Community - July 18, 2025

Alibaba Cloud Project Hub - November 12, 2025

Alibaba Cloud Community - July 14, 2025

134 posts | 26 followers

Follow Quick BI

Quick BI

A new generation of business Intelligence services on the cloud

Learn More Big Data Consulting for Data Technology Solution

Big Data Consulting for Data Technology Solution

Alibaba Cloud provides big data consulting services to help enterprises leverage advanced data technology.

Learn More Big Data Consulting Services for Retail Solution

Big Data Consulting Services for Retail Solution

Alibaba Cloud experts provide retailers with a lightweight and customized big data consulting service to help you assess your big data maturity and plan your big data journey.

Learn More Cloud Migration Solution

Cloud Migration Solution

Secure and easy solutions for moving you workloads to the cloud

Learn MoreMore Posts by Alibaba Cloud Project Hub