1. The US stock data from Nasdaq is considered by a large number of brokers and investors in China to be the standard data source.

- A total of 16 exchanges are operating in the US stock market. These exchanges can issue the same stock at different prices. This practice is well accepted in the US. However, investors in China expect a unified price for each stock.

Today, all the 10 major stock trading apps in China use the US stock data from Nasdaq. The US stock data from Nasdaq has been accepted as the benchmark for brokers in the industry to explore business opportunities in the US stock market.

- Since May 17, 2021, Nasdaq has promoted its daily closing data as the US composite closing data for investors in China.

2. The high-quality US stock data from Nasdaq has become a benchmark in the industry:

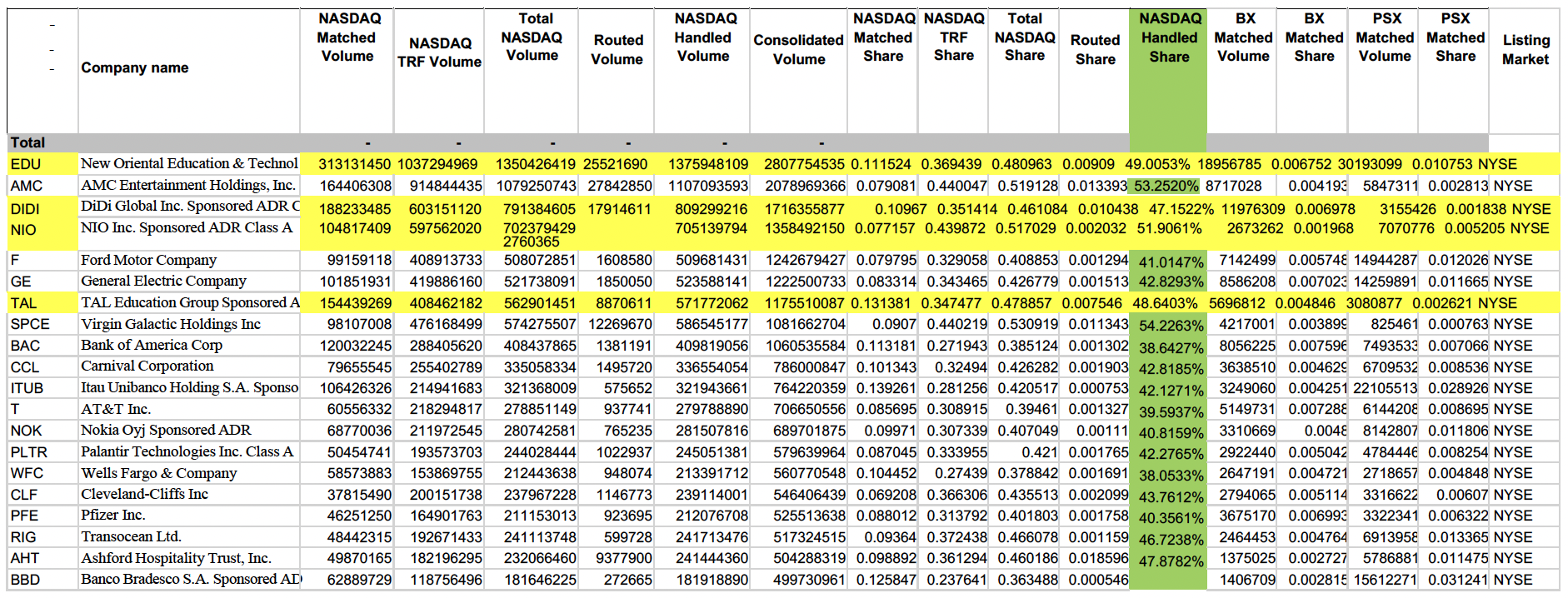

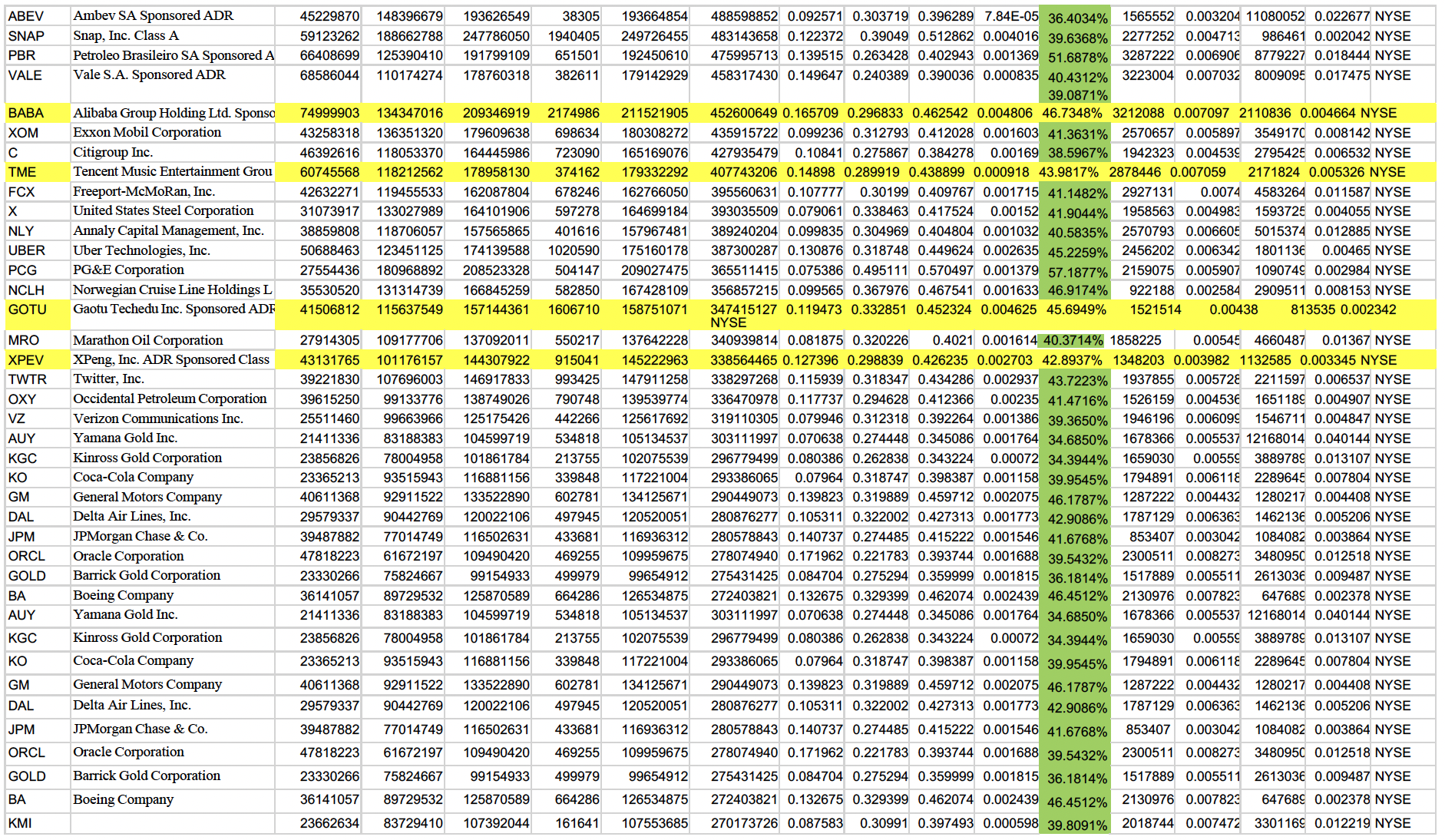

- The 16 exchanges in the US stock market can trade the stocks that are listed on any of these 16 exchanges. Every exchange considers the market share of its trade volume to be a crucial factor that affects the quality of its stock data.

In addition, more than 40% of stock trades in an exchange occur outside the exchange due to the quote mechanism of FINRA/Nasdaq Trade Reporting Facility. These stock transactions must also be considered when the exchange calculates its market share.

Based on stock data that is made public, 43.5% of the stocks that are listed on New York Stock Exchange (NYSE) are traded in Nasdaq, nearly 60% of the stocks that are listed on Nasdaq are traded in Nasdaq, and Nasdaq wins 70% of the public offerings (IPOs) in the US stock market.

Some China Concept Stocks are not listed on Nasdaq. However, the trade volume of these stocks in Nasdaq accounts for approximately 50% of the trade volume of these stocks in the US stock market. Therefore, the US stock data from Nasdaq has become the benchmark for the stock industry and market.

(Source: www.nasdaq.com)