J.P. Morgan is the world's largest financial service institution, serving clients in every corner of both business and geographical regions. One of J.P. Morgan's biggest contribution in the field of blockchain is the establishment of the Interbank Information Network (IIN).

Recently, J.P. Morgan announced a digital coin for payments called JPM Coin. This article briefly introduces the JPM Coin. We hope this article can inspire some thoughts on the new application directions of blockchain.

This article will answer the following three questions:

IIN serves to address the cross-border payment issues in all major markets including Americas, Asia, Europe, Middle East, and Africa. Launched as a pilot in October 2017, IIN was developed to reduce the cross-border payment delay, and fight back against the threat of emerging non-bank competitors (such as TransferWise). Currently, the total amount monthly payments handled by TransferWise is more than three billion euros.

IIN improves client experience by reducing the time and cost required for payments from weeks to hours, solving the problem of payment delays. The blockchain capabilities make us rethink how global banks obtain and exchange key information between global banks. IIN was developed based on a special ledger powered by Quorum, J.P. Morgan's own blockchain. This ledger allows licensed banks to exchange information about compliance checks and other exceptions that prevent the completion of payments.

"Historically, correspondent banks communicate one-way, bank-to-bank, but we have transformed their interaction," said Suresh Shetty, Blockchain Technology Lead for IIN. "When a payment detail is flagged for confirmation, different parties can interact simultaneously, requesting and sharing information."

The interbank network refers to the connection between interbank financial institutions (such as commercial banks, securities companies, and insurance companies) based on the needs of liquidity management and risk diversification. There are two types of interbank networks: directly connected networks and indirectly connected networks.

Directly connected networks mainly refer to credit and debt connections established on the basis of the assets and liabilities held by banks, such as direct loans, derivatives, and repurchase agreements.

Indirectly connected networks mainly refer to indirect connections established by banks through holding common assets and overlapping investment portfolios. The effect of these connections is mainly reflected by systemic risks caused by the price drop of common assets held by the banking industry.

Does the development of JPM Coin have any impact on the Interbank Information Network (IIN), J.P. Morgan's new blockchain network? To address this issue, it is important to note that IIN transfers information, not payments, between correspondent banks.

The JPM Coin, representing fiat currency, is designed to instantaneously transfer value. The JPM Coin transmits value instantly by reducing the settlement risk and cost of the client and the client's counterparty. The interaction and feedback mechanisms and the transmission chains of various risks in the complex financial system are sophisticated. J.P. Morgan must prevent and resolve systemic financial risks more effectively, and measure and describe the transmission mechanism of financial systemic risks promptly and accurately.

Quorum is an enterprise-ready distributed ledger and smart contract platform. Quorum is an enterprise-focused version of Ethereum. Quorum provides private smart contract execution and enterprise grade performance with single blockchain architecture.

Quorum is ideal for any application requiring high speed and high throughput processing of private transactions within a permissioned group of known participants. Quorum addresses specific challenges to blockchain technology adoption within the financial industry, and beyond.

Quorum is an Ethereum-based distributed ledger protocol that has been developed to provide the Financial Services Industry with a permissioned implementation of Ethereum that supports transaction and contract privacy.

Quorum is a private/permissioned blockchain based on the official Go implementation of the Ethereum protocol. Quorum uses a voting based consensus algorithm, and achieves Data Privacy through the introduction of a new "private" transaction identifier. One of the design goals of Quorum is to reuse as much existing technology as possible, minimizing the changes required to go-ethereum in order to reduce the effort required to keep in sync with future versions of the public Ethereum code base.

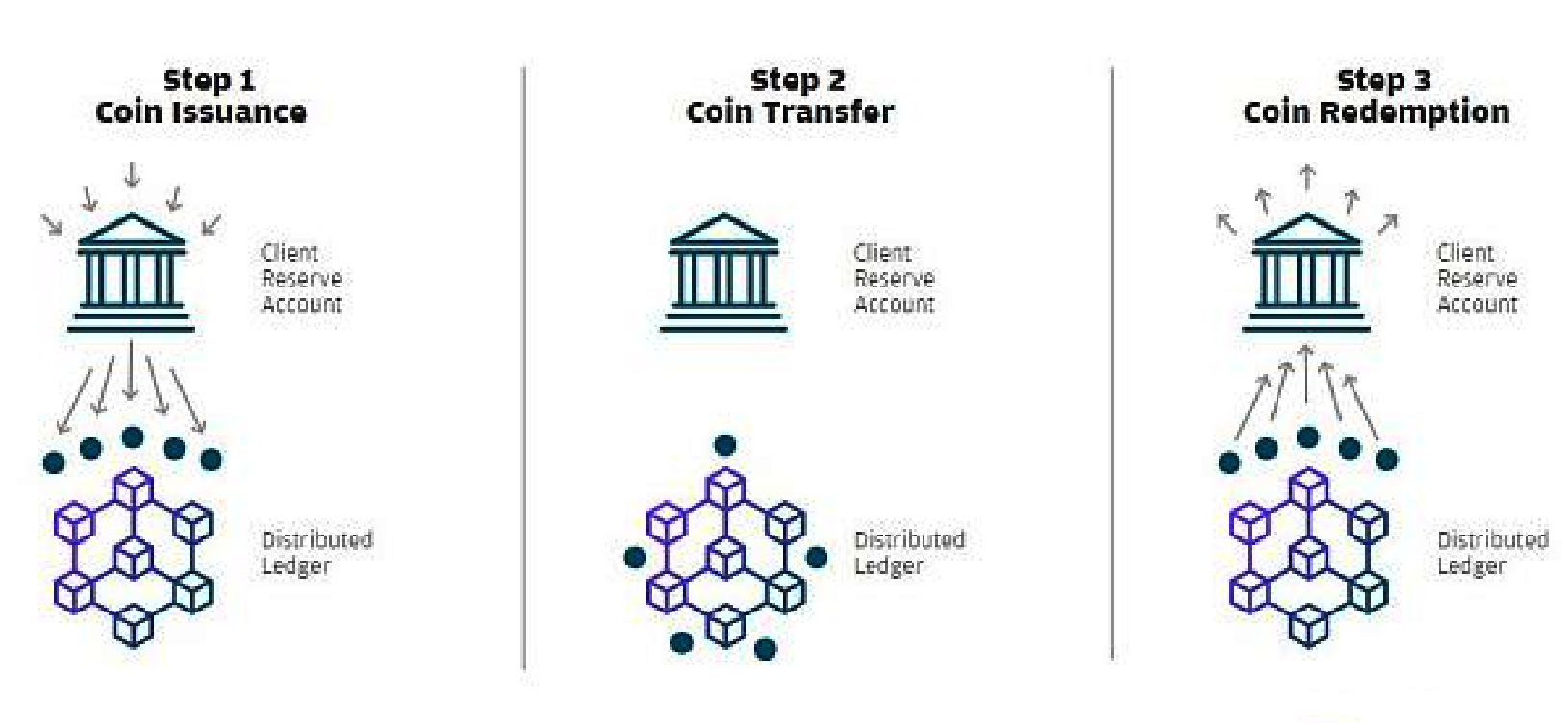

The diagram below is a simple representation of how the process works.

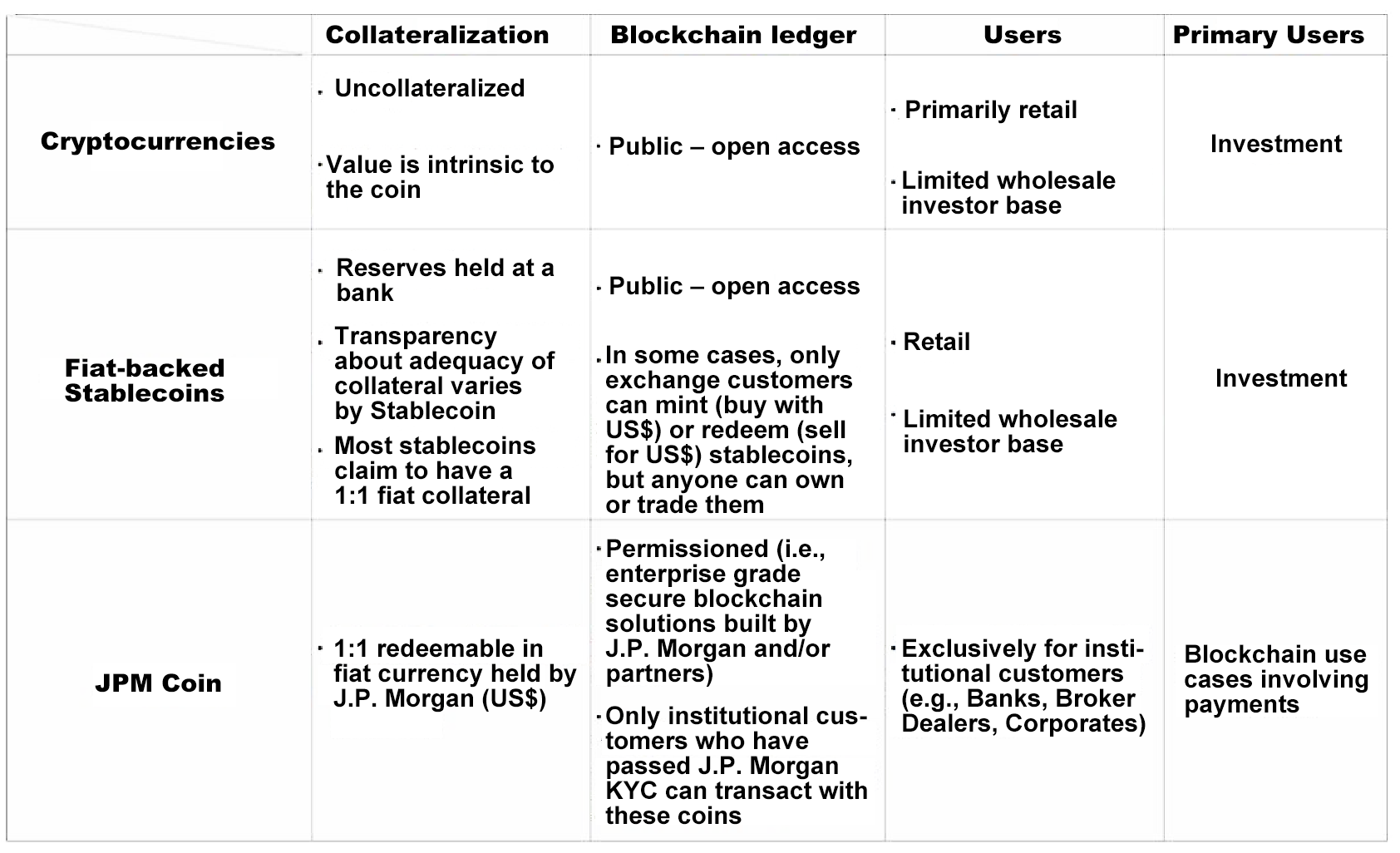

The wide use of cryptographic techniques by mainstream financial enterprises has four potential effects. The JPM Coin is a token that is issued on J.P. Morgan private blockchain network to the authorized users only. J.P. Morgan has the full control over the JPM Coin. It is not a typical decentralized cryptocurrency that is circulated on the open market. Although the JPM Coin is pegged to USD a 1:1 ratio, it cannot be circulated in the open market. Therefore, it is not a typical stablecoin. Instead, it is only an internal settlement token of J.P. Morgan. It does not introduce the fiat money to the cryptocurrency market, nor will it provide liquidity to the crypto-asset market as USDT does.

First: The use of cryptographic techniques by large financial companies will be extended to the settlement between them. This establishes a cryptographic technique-based settlement network that reforms the conventional SWIFT-based international settlement system.

Second: The new financial settlement, after coming into being, will pose great challenges to cryptocurrencies that are mainly designed for international settlement (such as Ripple and small BTC main blockchain). After all, a centralized system has higher efficiency.

Third: The development of the cryptographic technique-based mainstream financial system is in favor of the development and popularization of cryptographic techniques, devices, and knowledge. In the end, it helps with the development of decentralized cryptocurrencies.

Fourth: The application of cryptographic techniques in the mainstream financial system will accelerate the formation of the global cryptographic infrastructure. Together with decentralized cryptocurrencies and other cryptographic applications, it accelerates the development of the world's cryptoeconomy.

There are three early applications for the JPM Coin, according to Farooq, head of J.P. Morgan's blockchain projects

First: International payments for large corporate clients

International payment now typically happens using wire transfers between financial institutions on decades-old networks like Swift. Instead of sometimes taking more than a day to settle because institutions have cut-off times for transactions and countries operate on different systems, the payments will settle in real time , and at any time of day when using the JPM Coin, he said.

Second: Securities transactions

In April, J.P. Morgan tested a debt issuance on the blockchain, creating a virtual simulation of a $150 million certificate of deposit for a Canadian bank. Rather than relying on wires to buy the issuance - resulting in a time gap between settling the transaction and being paid for it - institutional investors can use the JPM Coin, resulting in instant settlements.

Third: Use J.P. Morgan's treasury services business to replace the dollars that huge corporations hold in subsidiaries across the world

The business handles a significant chunk of the world's regulated money flows for companies from Honeywell International to Facebook, moving dollars for activities like employee and supplier payments. It generated $9 billion in revenue last year for the bank.

Money sloshes back and forth all over the world in a large enterprise. If there is a way to represent cash on the balance sheet, for example, using the JPM Coin rather than actually wiring the money, the companies can significantly reduce costs.

Application Traffic Replication through a Kubernetes Ingress Controller

Building an Enterprise-Grade Ecosystem with Blockchain and the Cloud

15 posts | 8 followers

FollowWei Kuo - August 30, 2019

Alibaba Clouder - August 12, 2019

Alibaba Clouder - January 4, 2021

Alibaba Clouder - December 21, 2020

Alibaba Clouder - April 8, 2019

Alibaba Clouder - May 31, 2018

15 posts | 8 followers

Follow LedgerDB

LedgerDB

A ledger database that provides powerful data audit capabilities.

Learn More Blockchain as a Service

Blockchain as a Service

BaaS provides an enterprise-level platform service based on leading blockchain technologies, which helps you build a trusted cloud infrastructure.

Learn More Function Compute

Function Compute

Alibaba Cloud Function Compute is a fully-managed event-driven compute service. It allows you to focus on writing and uploading code without the need to manage infrastructure such as servers.

Learn More Elastic High Performance Computing Solution

Elastic High Performance Computing Solution

High Performance Computing (HPC) and AI technology helps scientific research institutions to perform viral gene sequencing, conduct new drug research and development, and shorten the research and development cycle.

Learn MoreMore Posts by Alibaba Cloud Blockchain Service Team