By Amber Qin, an AML and sanctions expert at Ant Group and Sophia Wu, a security and risk management expert at Ant Group

Intelligent AML solutions need to achieve a fine balance between compliance, transparency, effectiveness, and efficiency, say Amber Qin and Sophia Wu from Ant Group.

The Financial Action Task Force’s (FATF) fourth round of mutual evaluations is under way. With the large number of assessment reports underway (both initial and follow-up), most countries are under pressure to achieve a certain extent of reform. This is not surprising given the fact that the money laundering, terrorist financing and proliferation financing risk landscape is changing by the day, and national authorities and private entities alike must endeavour to keep up.

Today, we face a set of new and complex challenges, ranging from corporate transparency and tax evasion, to Covid-19 epidemic-related scams. In response to such trends, policymakers and regulators are forging ahead with enacting more comprehensive laws and additional rules, while private entities are putting into place stricter compliance and risk mitigation measures. An intelligent AML solution will be a key tool for private enterprises to build up end-to-end AML controls that are comprehensive, effective, scientific, and safe.

Traditional compliance methods are not future proof. The digital finance age is upon us, and financial crime compliance must change with it.

In recent years, commercial and financial activities have moved to digital channels at a rapid pace. The sheer volume of commercial activities being conducted online has raised the likelihood of criminals exploiting digitalisation to provide a veil of anonymity, intensifying the challenge for private enterprises in monitoring for suspicious activities.

Traditional AML monitoring relies on manual investigations and the accumulation of human expertise in implementing monitoring rules. With the rapid growth in digital business activities, AML compliance requirements are becoming increasingly challenging, despite the vast amounts of organisational resources invested.

Without automated and intelligent solutions, AML compliance costs may grow at a speed that puts businesses at risk. However, complete automation and the use of new technologies like machine learning and natural language processing (NLP) also have the potential to create so-called ‘black-box’ model risks.

Ultimately, intelligent AML solutions need to achieve a fine balance between compliance, transparency, effectiveness, and efficiency. The onus is on the part of AML practitioners to explore and apply new technologies in a manner that suits each institution’s needs.

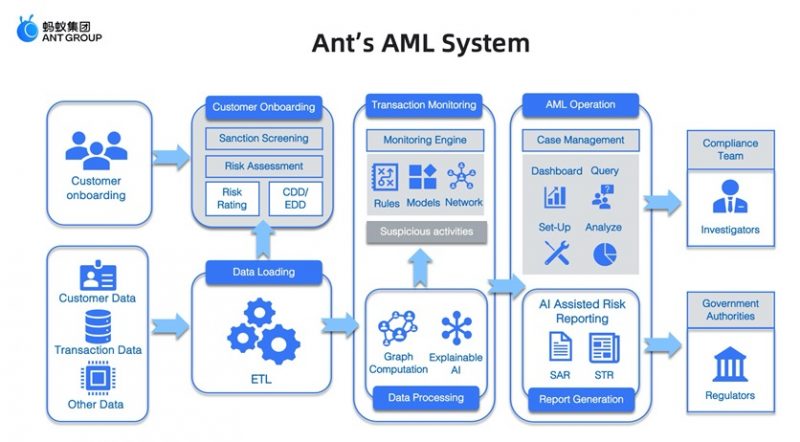

A good AML solution will need to combine traditional AML expert experience with new technologies. Data processing, artificial intelligence (AI), graph computing, optical character recognition (OCR) and privacy-preserving technologies need to be used alongside expert knowledge to build a digital, innovative and intelligent risk-based AML system that is truly capable of meeting the challenges of our time.

Technology can help to fulfil various needs in the AML compliance management lifecycle, from risk identification, black list screening, analysis and assessment, to regulatory reporting. Below we outline three key technology trends.

1. Graph-Based Risk Identification

Next-generation risk identification systems build upon the multi-dimensional features of today’s customer, transaction, and payments environment, allowing AML practitioners to form better judgments when monitoring for suspicious behaviour. By leveraging technical processes such as feature engineering, these new systems can enable intelligent detection and identification of suspicious behaviours and transactions, even faced with large volumes of data.

In traditional manual processing, an analyst’s view is limited to what the human eye can see, but in this day and age, criminals are becoming increasingly skilled at structuring and layering their activities through multiple types of hidden transactions. To address this challenge, with the help of Graph technology, systems can automatically extract, in real-time, red flags from different transaction monitoring dimensions (such as information relating to user devices or IP addresses).

The output from graph-based risk assessments can help analysts to more accurately and effectively construct, assess and fine tune monitoring rules to capture suspicious activities. In this way, analysts will be able to capture complex money flows through various products and channels, uncovering more complicated transactions and individual criminals who may otherwise go unnoticed.

2. Risk Analysis and Risk Assessment Powered by Explainable AI

The recent Gartner report, “Build Trust in AI Through Explainability”, highlights that regulatory bodies are demanding greater visibility into how organisations’ use AI. Some jurisdictions have introduced laws aimed at increasing the transparency of AI models, requiring industry leaders to familiarise themselves with the concept of explainable AI, both from a technological and a regulatory-compliance perspective.

When it comes to AML, Explainable AI technology is critical. Built on expert knowledge and experience, next generation AML systems will be able to more clearly demonstrate, in human language, the logic behind complex computations within AML workflows, making the analysis understandable and the results verifiable.

Identifying key features of customers and transactions that indicate potential risk will not only provide accurate and timely alerts, but also do so in a way that is unbiased and explainable. Accurate and unbiased risk analysis lends itself to flexible, individualised and targeted risk controls, which allows for a finer balance between needs for AML risk controls and more effective financial consumer protection.

3. AI and NLP Assisted Risk Reporting

Money laundering is a global issue. Although regulatory authorities are working towards a same goal, compliance requirements and processes often vary in different jurisdictions. New technologies such as OCR and AI are today increasingly being used to automatically parse AML guidelines and facilitate the reporting process.

While suspicious activities reporting is a key conduit for communicating financial crime intelligence, it is also a key indicator of an AML system’s effectiveness. A good SAR leverages the accumulation of expert experience, in-depth investigation and evidence-gathering. As a result, suspicious activity reporting is an area where obligated institutions would traditionally invest heavily in manpower.

Leveraging Explainable AI, AML systems today can build comprehensive risk profiles, and quickly generate the auxiliary information required for Suspicious Activity/Transaction Reports (SARs/STRs). This entails technological capacity-building in two key directions.

The first is in automated evidence gathering. By automatically extracting time-series patterns in suspicious activities/transactions, systems can help analysts to visualise networks at the transaction, account, individual dimensions. The structured display of evidence, packaged as a ready-to-use product, in turn supports quicker alert clearing, complex investigations and record-keeping.

The second is in intelligent data-to-text generation. Once again, extensive expert experience is key in building a risk feature knowledge base and conducting feature coding. Systems today can select specific risk features for automated text generation, make intelligent recommendations and text arrangements, and ultimately produce a draft report to be reviewed and filed by human experts. In this process, the highly repetitive yet prone-to-error manual work is reduced by intelligent means, made possible by explainable AI and NLP.

Risks and opportunities will always co-exist. We have a multi-fold challenge on our hand – to ensure regulatory compliance while supporting user growth; attain comprehensive risk coverage while minimising unnecessary user interruption; and manage business-as-usual processes while still taking the time and resources to invest in new technologies and people with the right skillsets.

Although not a path that can be tread lightly, we believe that the way ahead must be forged through steadfast investments and deeper collaboration with industry stakeholders. Together, we can achieve innovation in the AML/CTF space that is impactful, responsible, and sustainable.

How to Apply Fine-Grained Security Control to a Container Platform Using Container Firewall

1,353 posts | 481 followers

FollowIain Ferguson - April 4, 2022

Alibaba Cloud Community - January 13, 2026

Alibaba Cloud Community - January 13, 2026

Alibaba Cloud Community - July 27, 2023

Neel_Shah - November 21, 2025

Alibaba Cloud Community - April 8, 2022

1,353 posts | 481 followers

Follow Financial Services Solutions

Financial Services Solutions

Alibaba Cloud equips financial services providers with professional solutions with high scalability and high availability features.

Learn More FinTech on Cloud Solution

FinTech on Cloud Solution

This solution enables FinTech companies to run workloads on the cloud, bringing greater customer satisfaction with lower latency and higher scalability.

Learn More ZOLOZ Smart AML

ZOLOZ Smart AML

Comprehensive, Intelligent Detecting, Big Data-Driven Anti Money Laundering (AML) Solution

Learn More SOFAStack™

SOFAStack™

A one-stop, cloud-native platform that allows financial enterprises to develop and maintain highly available applications that use a distributed architecture.

Learn MoreMore Posts by Alibaba Cloud Community