In order to win this inevitable battle and fight against COVID-19, we must work together and share our experiences around the world. Join us in the fight against the outbreak through the Global MediXchange for Combating COVID-19 (GMCC) program. Apply now at https://covid-19.alibabacloud.com/

By Li Jingxia from Qing Jin Rong.

In the past, buying food from a bank without leaving home was unimaginable.

On February 14, 2020, Bank of Weifang launched a mini program, allowing residents in Weifang city, Shandong province to buy affordable food. Through this, Bank of Weifang has been carrying out a public welfare activity, allowing citizens to buy fresh vegetables through the bank's online channel with no price difference. Vegetables are delivered to customers' homes by SF Express.

This activity enables the bank to offer customers convenient services beyond its traditional business scope. The bank can serve its customers in a way similar to how the Internet serves its users. After the bank defined the requirements, it took only 48 hours to design, publish, and launch the mini program. Moving quickly, the bank can conduct business at the speed of today's Internet.

The success in creating this mini program relied on the bank's innovative management and the technical support of Alibaba Cloud and Mini Program Cloud.

How does a bank keep its business afloat during an epidemic? Offline business channels may have been suspended and many users may be handling business online, but these new challenges have encouraged the banking industry to innovate and explore unconventional approaches to business.

A city commercial bank headquartered in Weifang city, Shandong province, the Bank of Weifang's total assets of more than 140 billion yuan (more than 19 billion dollars) and its scale is similar to that of other city commercial banks. However, the bank's recent business activities were highly praised by peers and customers.

The bank cooperated with Alibaba Cloud to launch a mini program that enables city residents to buy affordable food without leaving home, with no price difference to food sold through traditional channels.

Residents can buy food the same way they would buy it from an e-commerce platform. Residents can enter keywords such as "Weifang bank food" or open the mini program in the bank's public WeChat account. Residents who place orders before midnight can receive food deliveries to their homes the next day.

The mini program is a portal that provides convenience services for residents through the bank's online platform. Through this product, the bank can touch the lives of many city residents. The mini program seems simple and easy to manage, but there were many factors that required attention to ensure it could run properly.

First, the bank needed a stable and reliable source of goods. To ensure the quality of the source of the goods, the bank compared multiple candidates and conducted an onsite survey, after which they selected the best food suppliers.

Second, the suppliers are required to provide a food inspection report before delivery. This gives residents a worry-free experience, and creates an additional sales channel for some farmers to help them during the upheaval brought by the coronavirus. The bank also works hard to select food and the bank staff monitors the food distribution process to ensure food safety.

Digitization has assumed an important role in mitigating the adverse impact of the epidemic. How can we overcome our challenges? Innovation is the key. The Bank of Weifang is a good example of how innovation can be used to extend business to every aspect of residents' daily lives.

Sometimes, innovation is just that simple.

The online food purchase service created by the Bank of Weifang is not only a convenience service for local residents, but also a portal for the bank to conduct business on the Internet.

This is the biggest change of the Bank 4.0 era. A bank is no long just a venue but is also a kind of service, and a platform. Traditional banks have started to extend their business to the Internet. This cooperation between the banking industry and the Internet depends on not only the introduction of Internet technology to banks but, more importantly, the business philosophy and thinking pattern of Internet businesses. Banks can get a lot out of the Internet.

Before creating this mini program, the Bank of Weifang had been exploring how to extend its business scope beyond the banking industry. Alibaba Cloud and the bank started cooperating based on their common exploration of industrial finance cloud.

On one hand, the bank hopes to transfer finance to customers and the industry, and to improve the bank's digital capabilities by leveraging financial technologies and the resources and traffic of Alibaba's ecosystem.

On the other hand, Alibaba Cloud hoped to bring customers, the industry, and the ecosystem together to streamline financial services. When the Bank of Weifang gave Alibaba Cloud their requirements for the program, they used their technical prowess to help the bank get the results it wanted as quickly as possible.

A mid-end was required to enable the bank to respond to the frontend business with agility. In the future, the bank will deepen its cooperation with Alibaba Cloud in fields such as the business mid-end, data mid-end, telecommuting, and industrial finance.

Alibaba Cloud also provided the Bank of Weifang with a DingTalk-based solution for the bank employees to report their health status. It is important for financial institutions to ensure the health of employees during the epidemic so that they can provide onsite services safely. DingTalk provides financial institutions with a complete set of digital office solutions, such as health reporting, intelligent approval, multi-role collaboration, project task allocation, and workplace training.

DingTalk has helped many banks and insurance companies to conduct online management and digital business, which are vital functions for business survival.

Alibaba Cloud and the Bank of Weifang will continue their multidimensional cooperation and jointly build a cloud-based smart ecosystem.

In addition to financial services, a bank can also provide an Internet-based service platform to serve customers in all scenarios, not just during epidemics. This possibility is being explored by banks in the industrial finance field. When a bank extends its business to all walks of life, it can have deeper access to the Industrial Internet, obtain more transaction data, and find more ways to deal with the financial challenges of the Industrial Internet.

The mini program was not the first option considered by the bank at the beginning.

Initially, the bank wanted to provide the vegetable purchase service through a smartphone app. However, the bank encountered two problems. One problem was that its mobile banking app had a low traffic volume and covered very few customers. The other problem was that developing an app requires a large investment in technology.

Instead, after deep deliberation with Alibaba Cloud, the bank decided to use a mini program for the vegetable purchase service. Alibaba Cloud developed the mini program in just two days to allow residents to buy vegetables online, with contactless delivery. The mini program is available in Alipay and WeChat.

This means that the large number of users accumulated by Weifang Bank's WeChat Bank can be quickly converted. In Alipay, there will also be a "love cheap dishes" column for local residents in Weifang to use.

How was it possible to launch the mini program for online food purchase in such a short time? The speed of the development and launch can be attributed to three factors: (1) Alibaba Cloud's solid technologies and accumulated experience in partners' scenarios; (2) products of the bank and Alibaba Cloud; (3) highly agile teams on both sides.

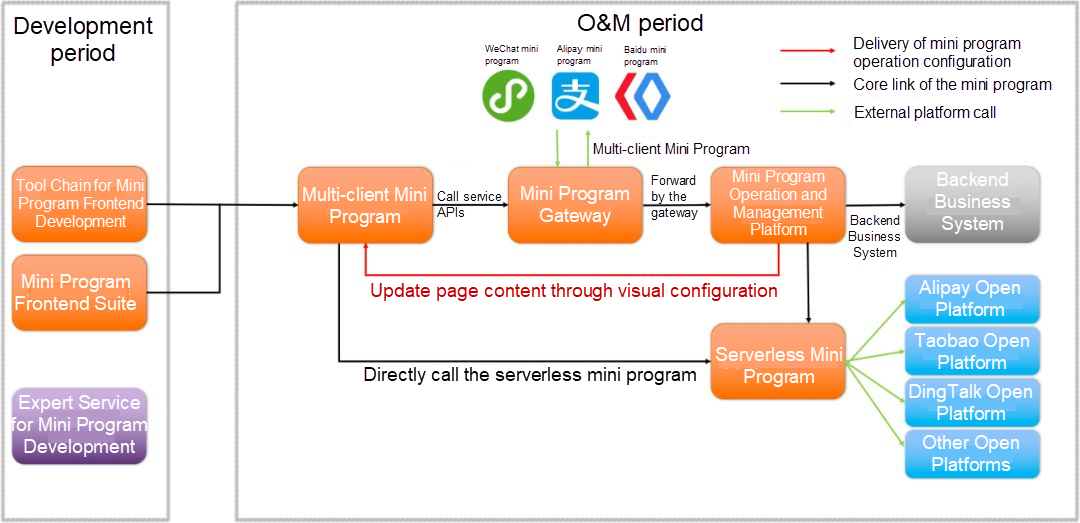

Technically, Alibaba Cloud helps the bank reach customers and link to various industries through Mini Program Cloud on the public cloud.

The most important factor for the mini program is the comprehensive cloud services supporting it. Mini Program Cloud allows the bank to promote its business to a large audience and quickly integrate its business branches.

Many developers work on the Alibaba Cloud platform, and a large number of third parties provide services in different industries. The mini program template for online food purchase was developed by an e-commerce eco-partner on the Alibaba Cloud platform, while Alibaba Cloud provided technical support.

The mini program is the result of joint exploration by the Bank of Weifang and Alibaba Cloud on how to provide convenience services for citizens. The mini program template can be quickly replicated to other businesses of the bank. In the future, Mini Program Cloud will work closely with Alibaba's open platforms to help developers and enterprise customers in all industries quickly connect to the Alibaba ecosystem.

Alibaba Cloud's digital concepts and innovative product technologies are integrated into the solutions of many financial institutions.

Check out the original Chinese article here.

While continuing to wage war against the worldwide outbreak, Alibaba Cloud will play its part and will do all it can to help others in their battles with the coronavirus. Learn how we can support your business continuity at https://www.alibabacloud.com/campaign/fight-coronavirus-covid-19

Learn How the Industrial Internet is Helping Enterprises Get Back on Feet Faster

How Efficient Can Remote R&D Be? Alibaba Released a New Taobao Mobile Version in Five Days

2,593 posts | 792 followers

FollowAlibaba Clouder - April 16, 2020

Alibaba Clouder - March 24, 2020

Alibaba Clouder - April 13, 2020

Alibaba Clouder - April 23, 2020

Alibaba Clouder - April 29, 2020

Alibaba Clouder - March 31, 2020

2,593 posts | 792 followers

Follow ECS(Elastic Compute Service)

ECS(Elastic Compute Service)

Elastic and secure virtual cloud servers to cater all your cloud hosting needs.

Learn More OSS(Object Storage Service)

OSS(Object Storage Service)

An encrypted and secure cloud storage service which stores, processes and accesses massive amounts of data from anywhere in the world

Learn MoreLearn More

More Posts by Alibaba Clouder