By Alan Qi

Artificial Intelligence (AI) technologies have become a major driving force for the financial sector as financial technologies continue to evolve.

In the "Financial Intelligence" session of the Yunqi Conference held in Yunqi Town, Hangzhou, on September 27, Dr. Alan Qi, chief AI scientist, head of financial intelligence at Alibaba DAMO Academy, and vice president of Ant Financial, gave an opening speech to share Alibaba's thoughts and practices in financial intelligence with guests. The speech covered core technological fields, such as complex network, intelligence sharing, knowledge graph, deep learning, and how these technologies are used at Ant Financial to practice the ideology of "in-depth, considerate financial technologies" based on "AI + sustainable and inclusive financial services."

Full transcript of Alan Qi's speech.

The latest survey shows that 1.7 billion people across the world, accounting for 50% of the total number of laborers worldwide, still have never used banking services. In addition, financial services significantly differ across different regions and groups and are particularly unfriendly to people with low income, females, minority groups, and under-developed regions. This is to say, financial services have a long way ahead before becoming inclusive enough.

AI is one of the core driving forces of inclusive finance. I would like to share the thoughts and practices of Ant Financial in promoting financial intelligence. Finance and AI are mutually supportive. With the help of AI, financial services can better control risks, become more efficient, improve user experience, and reduce information asymmetry. As the most digitalized sector, financial services provide diversified scenarios for applying AI and are also highly motivated to develop and use AI because it significantly improves financial services.

From the financial sector perspective, what are the current opportunities and challenges for financial intelligence? Complex dynamic network, adversary, human-machine collaboration, fairness, data security, and privacy protection, and uncertainty. These are the major fields where we see financial intelligence making real differences.

Networks are everywhere throughout financial services, including networks among consumers, vendors, and commodities, and social networks. Networks generate large amounts of structured data and result in strong network effects, such as cooperation or competition. Modeling and analyzing the networks is challenging, but also interesting.

The scale itself poses a challenge. Ant Financial has served tens of millions of vendors and 1.2 billion users worldwide and provides over one million services and mini-programs. The large amounts of data and a huge ecosystem behind these numbers force us to figure out an efficient way to extract useful information out of these massive and noisy data to establish a sound system of financial services.

For example, the use of machine learning to analyze large amounts of data to prevent attempted fraud in cashing loans and buying medical insurance with hidden diseases is very important. Ant Financial has made advances in these regards, which are introduced in an AAAI 2019 publication titled, The Importance of Critical Routes of Attention- and LSTM-based GeniePath Learning Network. The GeniePath Learning Network records a 95% accuracy rate in preventing insurance fraud.

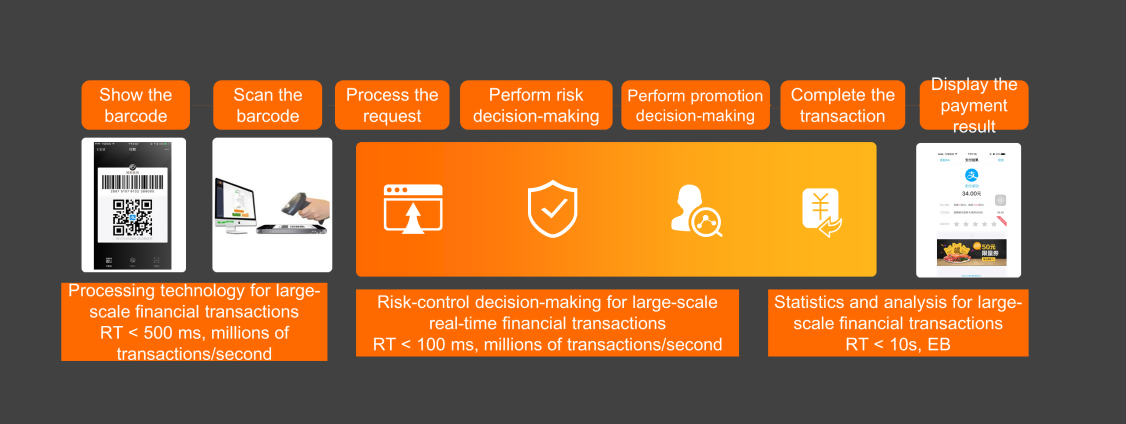

Every transaction can be seen as a case of human-system adversary. This combination of the adversary and aforementioned large-scale network and real-time processing demand will pose greater challenges. For example, a seemingly simple Alipay payment includes multiple procedural nodes. Payment transactions between consumers and vendors form a large relation network that requires results to be returned in nearly real-time. This requires that the risk control decisions related to adversary must be made within 100 ms. This is absolutely a tough job.

In serving a plethora of users, scalability is fundamental in this process and requires freeing humans from the process to achieve automation. But on the other hand, human intervention is also necessary for the financial system to prevent disastrous risks or system errors. In such hybrid human-machine systems, we need to make sure that the machine prediction and decision-making can be explained, the automation algorithms can be monitored and interrupted, among others.

Disadvantaged groups, such as females, minority groups, and low-income people, have the right to enjoy financial services equal to others. But standardized methods easily and unknowingly lead to bias. Perfect fairness and the accuracy of algorithms are likely to collide. As machine intelligence plays an increasingly critical role in more and more systems, the design of proper algorithms and metrics to reduce and prevent bias has emerged as a key research direction.

Becoming the target of the entire society's attention, service providers always hope to bring together previously isolated data to generate more values. But data security and privacy also need protection. These two goals are conflicting, and we must deal with the challenge to find a perfect balance between them.

In reality, 'Black Swan' events are disastrous for the financial sector. The source of these uncertainties can be non-linear feedback, hidden variables, or complex dynamic networks. Machine learning in the current status lacks powerful tools to deal with these problems. We have seen a promising direction of combining economic theories, such as the game theory and mechanism design, with machine learning, to push forward the progress of adversary learning, machine learning-based mechanism design, multi-intelligent agents, and causal analysis.

There are other branches of financial intelligence, which are challenging but also prove to be good opportunities. Every step forward in these branches promotes the advancing and real implementation of technologies in the financial sector.

Ant Financial is committed to providing inclusive financial services to vendors and consumers worldwide.

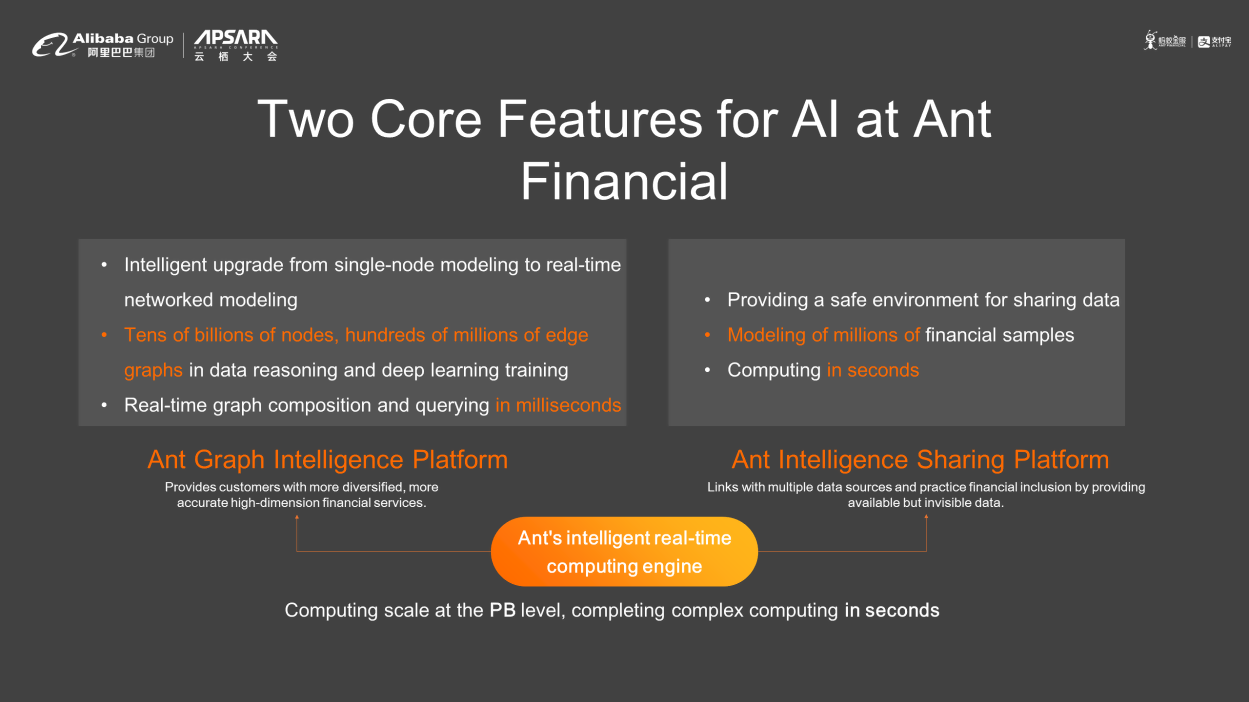

In past years, we managed to build two critical learning platforms, the Ant Graph Intelligence Platform and the Ant Intelligence Sharing Platform. The Ant Graph Intelligence Platform supports the reasoning of graph data that involves tens of billions of nodes and thousands of billions of edges, deep learning training, and graph composition and querying in milliseconds. The Ant Intelligence Sharing Platform provides the capabilities of secure, reliable data sharing and inter-institution modeling of machine learning algorithms to model millions of financial samples in seconds.

Based on graph intelligence technologies, we help enterprises become more capable of profiling risks and subsequently getting additional tens of billions of RMB of loans. Thanks to the upgrade from isolated modeling to networked modeling, which gets the most out of massive relation information. Another keyword is intelligence sharing, which applies to scenarios that involve multiple parties and where data providers and platforms do not trust each other. An intelligence-sharing mechanism is a learning form that brings together information on different parties and protect the data privacy of these parties. An earlier publication of ours (in Chinese) titled: Intelligence Sharing: Ant Financial's Data Island Solutions gives detailed technological descriptions. This is already being used in processing loans.

With intelligence sharing technologies, we enable our partners to control risks and jointly build up more powerful models. This ultimately allows us to cooperate with banks to grant loans. We hope to work with more financial institutions to strengthen risk control with intelligence sharing technologies and better serve customers. These practices and applications are supported by multiple years of development of fundamentals and accumulation of experience that began in 2015. We have over 50 patent applications that are being reviewed and have won a series of awards in this field.

We are leading the design of IEEE standards, Chinese National Standards, and industry standards for risk control with intelligence sharing technologies. Our complete solutions feature the combination of hardware and software and cover both scenarios where data is shared in a trustworthy environment out of its domain or stays within the local domain. In either scenario, intelligence sharing technologies ensure that involved parties cooperate to become more capable of risk control. Previous cases are examples of reinforcing risk control with AI. Coming next are cases of improving efficiency and user experience, as well as reducing information asymmetry.

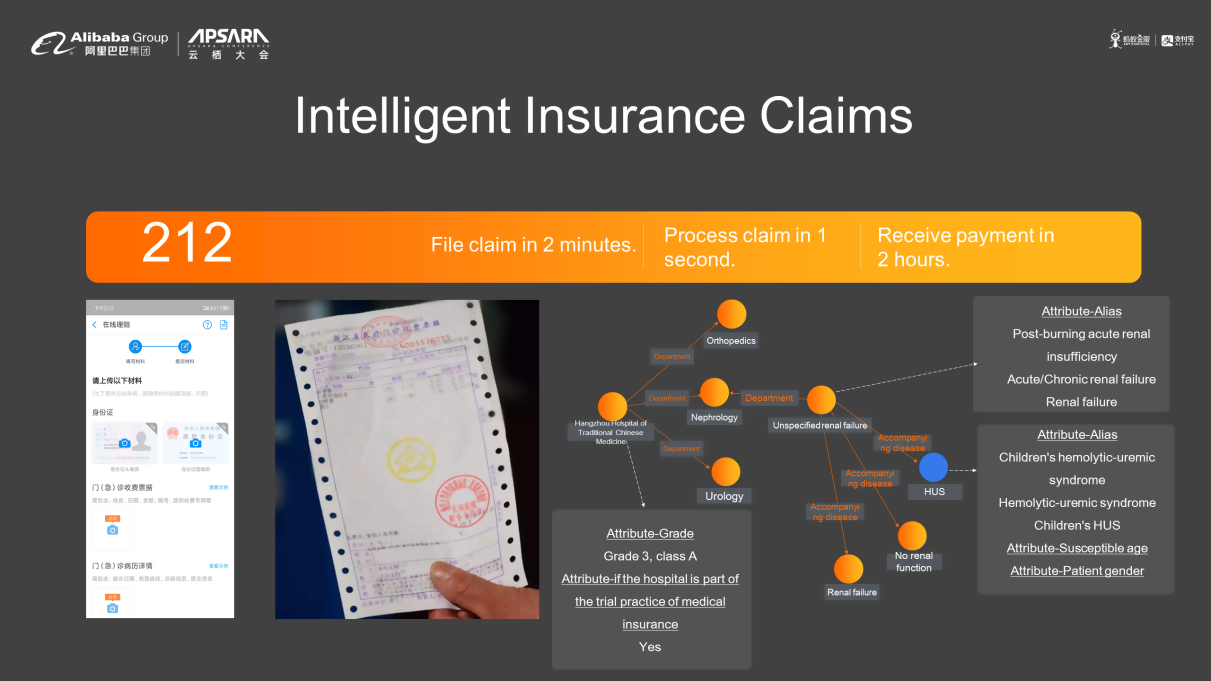

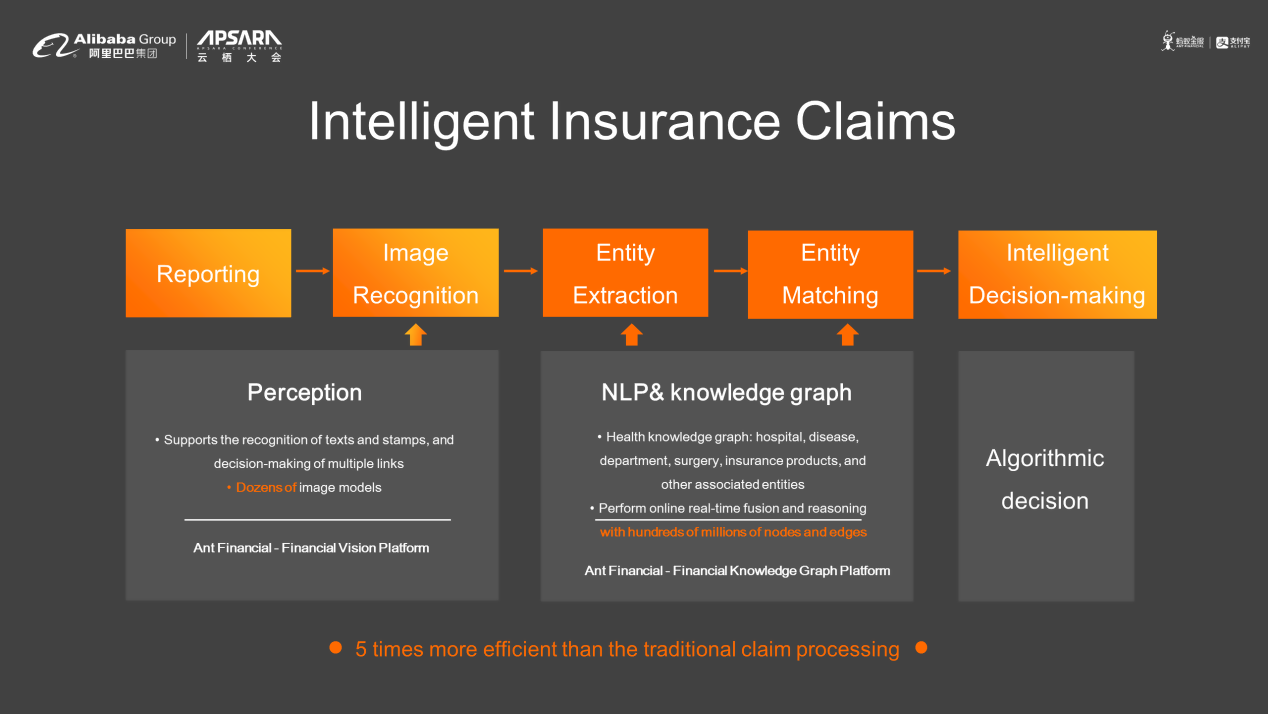

The first case is Intelligent Insurance Claims, a system designed to accelerate the processing of insurance claims by using AI. The "More-Collection-More-Insurance" service has covered tens of millions of online store owners nationwide. Ninety million people have joined Xianghubao (literally, mutual insurance), and 10 million elder people enlisted for Xianghubao (elder people version) in nine days after its launch. These insurance products make sure that insurance services extend to more people. However, the many documents and complex procedures pose great challenges regarding the costs of human processing of insurance claims.

The core concerns of the Intelligent Insurance Claims system are the improvement of service efficiency and the reduction of costs. The core capabilities of "More-Collection-More-Insurance" can be described with three numbers: 2 (filing a claim takes 2 minutes), 1 (processing a claim takes 1 second), 2 (insurance payment is received in 2 hours).

Here are the procedures:

(1) Users upload information through Alipay.

(2) The system recognizes unstructured texts and stamps in the information with financial-level image recognition capabilities and understands the meanings of the information through NLP and health knowledge graphs.

(3) The system extracts critical information for subsequent verification and reasoning to make decisions about intelligent insurance claims.

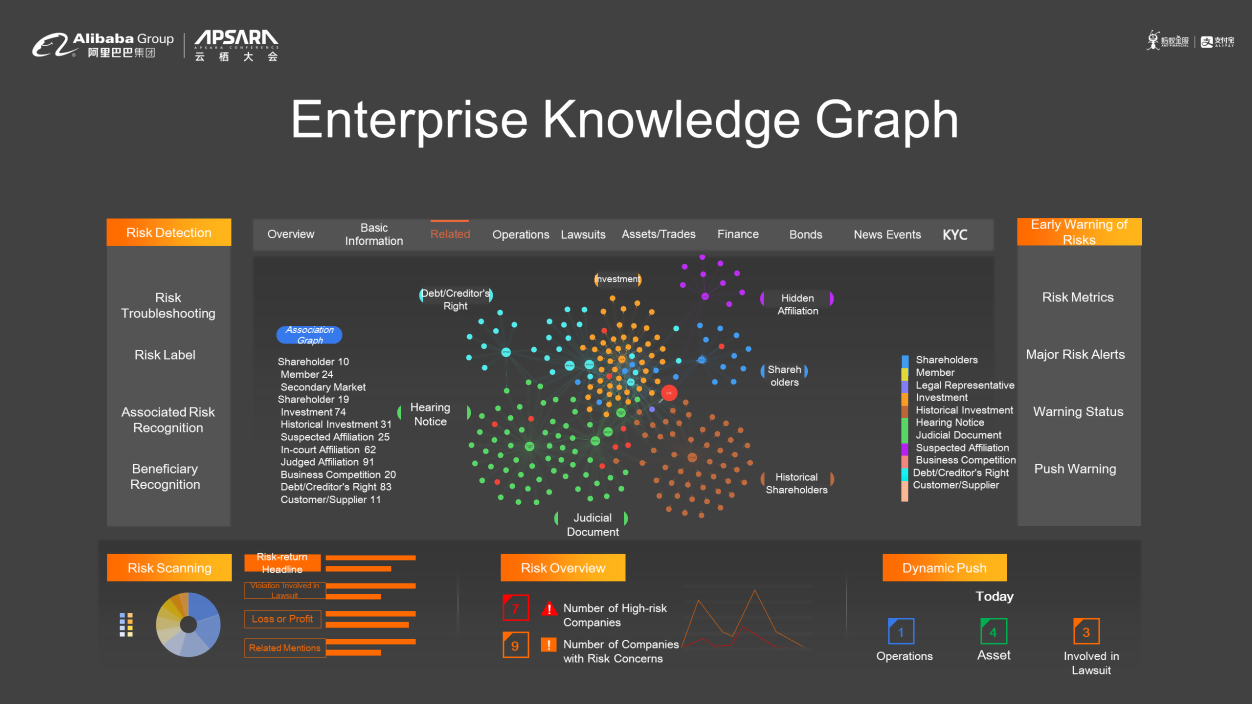

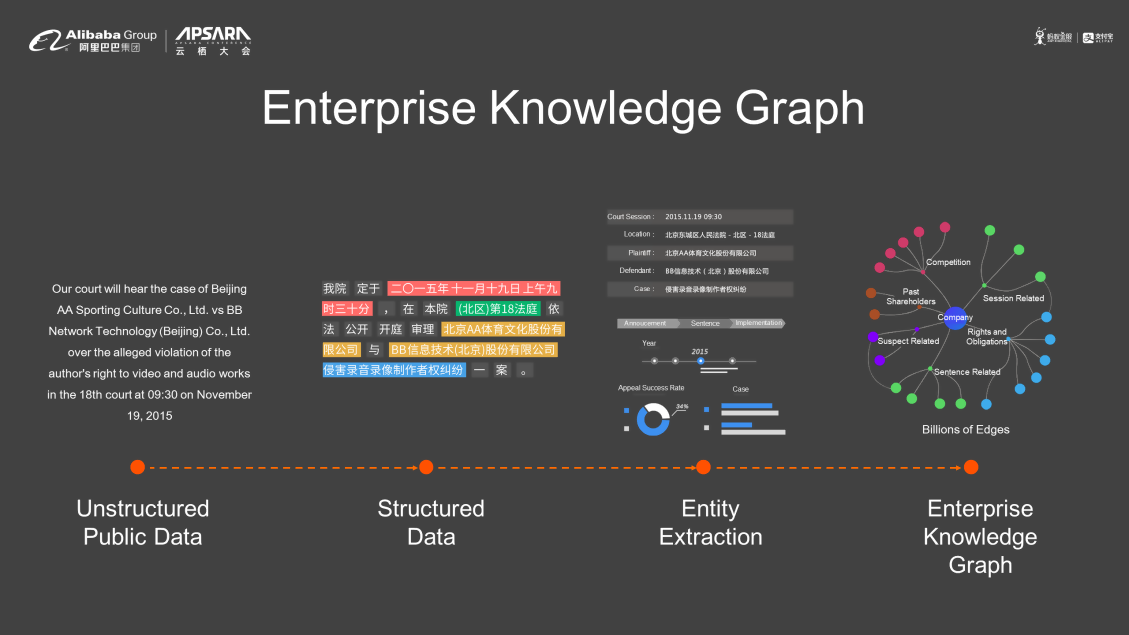

The other case is the Enterprise Knowledge Graph. Information asymmetry is the source of many financial risks. We hope that the knowledge graph platform reduces such information asymmetry. We transform unstructured data to structured data and connect data through associations to form the enterprise knowledge graph platform. This platform helps us understand the major risks we face, the risk index of a company, and relevant risk grades.

These are backed by an entire processing link. For example, we structure the unstructured legal text written in natural language, extract the major part of the text, and transform it into a valid knowledge graph that helps with analysis and reasoning.

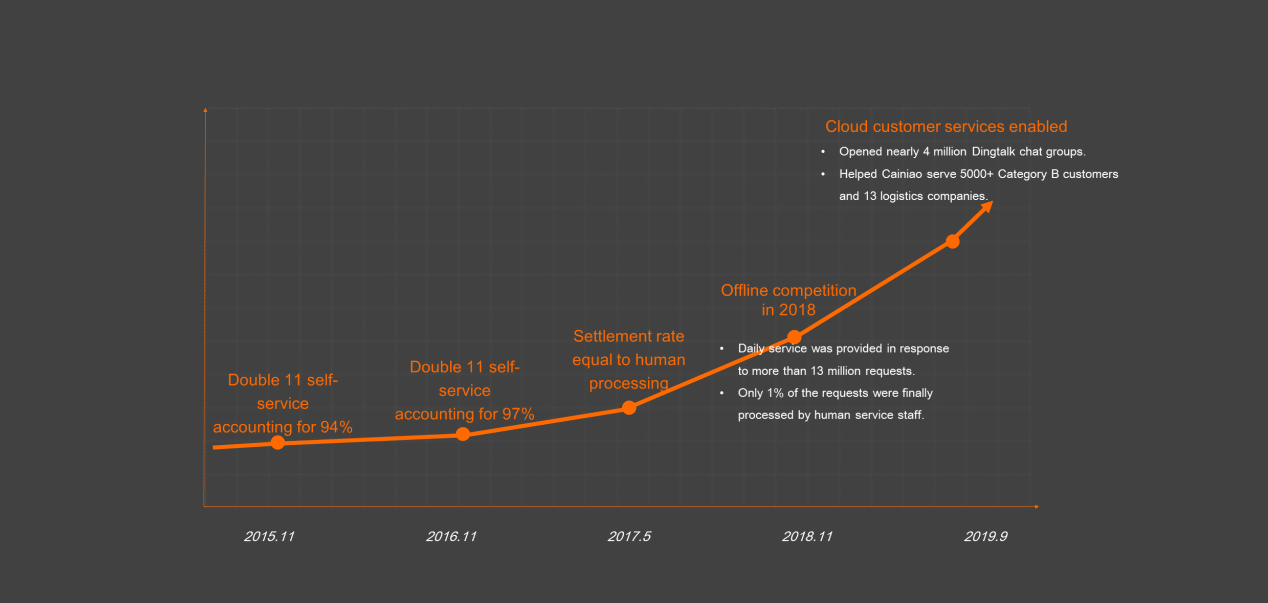

Let's move on to the improvement of user experience. How customers perceive customer services is important for financial institutions. We had about 450 million users in 2016, and 1.2 billion as of now. In the past few years, we kept launching new products and services, but the manpower of our customer services team did not increase proportionally to the number of users and the products, mainly thanks to AI. (Year) 2015 saw the percentage of self-customer services surge from 60% to 94%, followed by a further rise to 97% in 2016. In 2017, the average service quality of robots surpassed human services for the first time. In 2018, Alipay launched the voice purchasing of tickets.

This year, Cloud services are made available to customers through DingTalk and help Cainiao support many logistics companies. All these improved user experiences are backed up by AI. I will close this speech with an interesting voluntary project completed by my colleagues in the past few months - "Intelligent Garbage Classification." Correct classification of garbage is a key step in its recycling and treatment. Shanghai enacted garbage classification policies on July 1, 2019. Garbage classification reduces carbon emissions but is not an easy job for residents because correctly classifying over 1,000 types of garbage is challenging. So, several algorithm developers of Ant Financial and members of Alipay's product and operations team volunteered to team up and tackle this challenge.

Based on our existing image technologies, search technologies, intelligent assistant technologies, and knowledge graph platform, we quickly finished development in two weeks and launched the AI garbage classification application on July 15. With an over 90% accuracy in recognizing images, voices, and texts, this application identifies and classifies over 20,000 types of items. Moreover, the application had a record of 4 million DAU and 30 million calls after its launch for one week. Except for this application, we also teamed up with partners in the ecosystem and designed the IoT hardware of the 'intelligent garbage recycling bin.'

On September 27, our developers gave an on-site demonstration of Ant Financial's intelligent garbage classification solution at the 74th UN General Assembly in New York. This is our effort to use AI to implement the UN's sustainable development goals. Next, we will reinforce cooperation with Alibaba Cloud and partners in the ecosystem to spread intelligent garbage classification technologies across the entire garbage processing industry. Our long-term vision is to reduce carbon emissions in the garbage processing stage by 20% by 2025. We hope that technologies are advanced, and remain friendly and easily accessible. We are working hard to promote inclusive, sustainable financial services by using AI.

Ant Financial's Innovations and Practices in Online Graph Computing

12 posts | 2 followers

FollowAlibaba Clouder - September 28, 2020

Iain Ferguson - January 21, 2022

Alibaba Clouder - June 24, 2020

Alibaba Clouder - March 16, 2020

Alibaba Clouder - October 28, 2019

Alibaba Cloud Blockchain Service Team - January 17, 2020

12 posts | 2 followers

Follow AIRec

AIRec

A high-quality personalized recommendation service for your applications.

Learn More Artificial Intelligence Service for Conversational Chatbots Solution

Artificial Intelligence Service for Conversational Chatbots Solution

This solution provides you with Artificial Intelligence services and allows you to build AI-powered, human-like, conversational, multilingual chatbots over omnichannel to quickly respond to your customers 24/7.

Learn More Alibaba Cloud Model Studio

Alibaba Cloud Model Studio

A one-stop service platform for whole-process generative AI engineering and application development, based on Tongyi Qianwen (Qwen) and other popular models

Learn More Log Management for AIOps Solution

Log Management for AIOps Solution

Log into an artificial intelligence for IT operations (AIOps) environment with an intelligent, all-in-one, and out-of-the-box log management solution

Learn MoreMore Posts by Alipay Technology